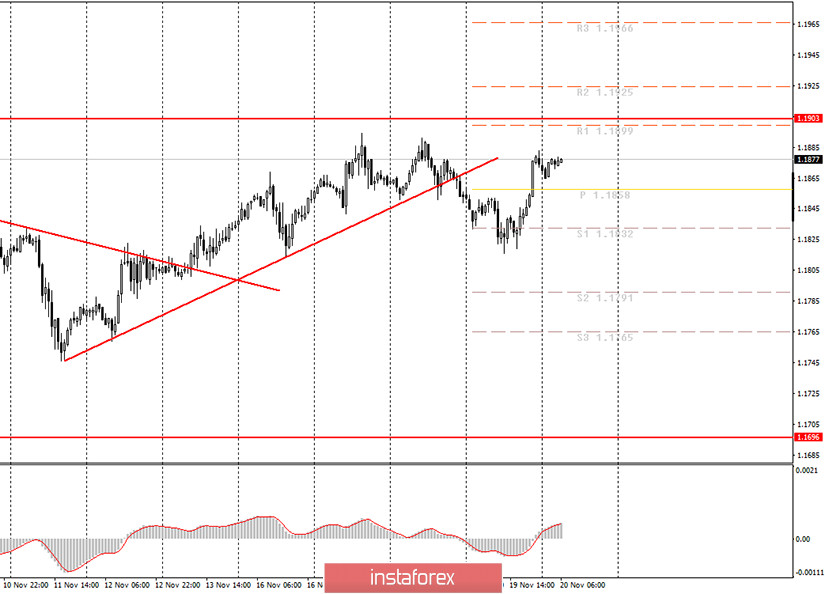

Hourly chart of the EUR/USD pair

The EUR/USD pair began to correct last night, as we expected in yesterday's evening review. However, as it became known in the morning, the correction turned out to be quite strong and at the moment the pair has practically reached two previous local highs. If the price manages to overcome them or update them, the technical picture will become very confusing. For novice traders, the existing technical picture does not threaten with losses or any problems. Last night we advised you to sell the pair using the new sell signal from MACD, which is after the correction ended. The MACD indicator did not generate sell signals in the evening, and the correction was not completed. Thus, at the moment we still believe that the EUR/USD pair will go back to falling to the lower border of the horizontal channel at 1.1700-1.1900. An upward trend can start forming only if the price confidently overcomes the 1.1903 level.

European Central Bank President Christine Lagarde is set to speak on Friday, November 20. It is unlikely for Lagarde to mention anything important, given the fact that she has already spoken three or four times this week. By and large, all of her speeches now concern the coronavirus epidemic, the creation of a vaccine, as well as the plan for economic recovery and the EU budget for 2021-2027, which was blocked by Poland and Hungary. However, as we can see, all these fears have no effect on the euro's rate. The single currency (euro) continues to trade in the upper area of the horizontal channel, and the US dollar cannot even rise in price by 1-2 cents. In a way, there is a stalemate. You can consider selling the pair, but only when a sell signal appears from MACD, and you can open buy positions, but first we must break the 1.1903 level. So now the only thing we can do is wait. Wait to see how the market will behave in the next few hours. And also wait for news from Europe and America. The EUR/USD pair has been trading very sluggishly this week. Volatility dropped to its lowest values, no more than 40-50 points each day. Therefore, the markets clearly need important new information to start trading more actively. Novice traders are advised to follow the development of the situation at this time and wait for a convenient time to open new positions. There are no major events scheduled in America today.

Possible scenarios for November 20:

1) Long positions are no longer relevant, since the price has settled below the upward trend line, therefore, the trend has changed to a downward trend. So now you can only return to buying the euro when the current downward trend has ended. Under current conditions, the only option is to overcome the 1.1903 level, which will mean that the pair will leave the 1.1700-1.1900 horizontal channel.

2) Trading for a fall has become relevant at this time, since the trend has changed to a downward one. We currently face an upward correction, and you must wait for it to end so that you can open new short positions with targets at 1.1832 and 1.1791. However, if the price renews the previous local highs (1.1891 and 1.1894), this could mean that the upward movement will still be present. However, we still recommend considering selling before breaking the 1.1903 level.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română