The New Zealand dollar against the US currency continues to break records. It managed to consolidate within the 0.69 level, approaching two-year price highs. There are a lot of important factors that contribute to the growth of this pair, especially amid the US dollar, which continues to show vulnerability. On the one hand, the current fundamental background allows us to unconditionally recommend long positions in the NZD/USD pair. But on the other hand, the proximity of the 0.70 level causes concern – negative reaction from the RBNZ may follow, as soon as buyers "swing" at this price target.

In fact, it is worth noting that RBNZ members, in fact, gave the go signal for the upward trend of the NZD/USD pair. During this year's last meeting, the regulator not only kept a wait-and-see attitude, but also stated their future prospects. In particular, Adrian Orr, Central bank's head, said that the country's economy turned out to be more stable than previously assumed. He also announced that the Central Bank intends to maintain the status quo at the rate at least until March next year. Thus, he made it clear that the bank will not introduce negative rates in the near future, since the current risks have become more balanced than before. The market was clearly surprised by such results of the November meeting, as most experts expected a "dovish" scenario.

This week, buyers of NZD/USD pair continued to rally upwards after a deep corrective pullback. This was supported by China's data, which mostly came out in the green zone. It became known that October's industrial production rose by 6.9% in annual terms, which exceeded the expectations of the market, with a forecasted growth by around 6.5% only. In addition, retail sales were also pleasant. The corresponding figure surged by 4.3% in October, after rising by 3.3% in September.

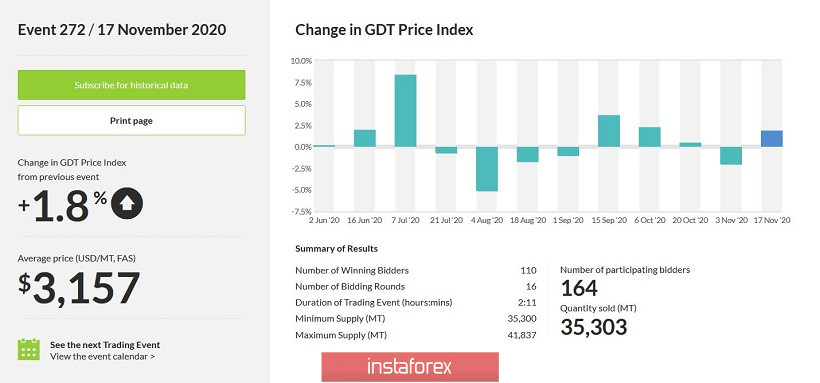

The New Zealand dollar received additional support in the form of growth in the price index for dairy products. At the first GDT auction in November, the trades closed in the red zone, although the index showed positive dynamics before that. Nevertheless, the indicator left the negative zone during the last auction this Wednesday and reached 1.8%, leveling the decline at the beginning of the month. At the same time, the recovery of the index was due to the strengthening of prices for most of the tradable categories of dairy products. Let me remind you that the cost of milk and the demand for it is quite important for the New Zealand economy, therefore, the current situation may have a corresponding impact on the mood of the RBNZ members. The island nation exports powdered milk and other dairy products mainly to China and Europe, so recent trends indicate higher demand from them.

On another note, COVID-19 which is exerting the strongest pressure on the US currency, has the opposite effect for the New Zealand currency. The fact is that New Zealand actually "defeated" COVID-19 not so long ago, and since then, there were almost no cases. For example, only three COVID-19 cases were detected in the country yesterday. At the same time, all infected were found during quarantine upon arrival in New Zealand. No cases of the spread of infection within the state were recorded.

Thus, RBNZ's wait-and-see attitude, China's growing data, the rise in the milk's price and the victory against COVID-19 allows the NZD to update price ranges. The US dollar, in turn, is still under pressure from fundamental issues. New coronavirus anti-records, conflict between the US Treasury and the Fed, slowing inflation and falling retail sales, the inability of congressmen to compromise on a new stimulus package to support economic recovery and the possible easing of the Fed's monetary policy parameters – all these fundamental factors play against the USD.

Therefore, we can consider buying the NZD/USD pair with the main goal of 0.7000 in the medium term. However, it is suggested to take profit after reaching this level. The Reserve Bank of New Zealand is concerned about the inflated exchange rate of the national currency, putting verbal pressure on it. The relevant signals have already been voiced by the country's trade minister. He believes that the current strengthening of the "kiwi" exchange rate is an unfavorable factor for the country's export-oriented economy.

From a technical viewpoint, we can also talk about the priority of long positions on the NZD/USD pair. This pair is on the upper line of the Bollinger Bands indicator and above all lines of the Ichimoku indicator on all bigger time frames, with the exception of the monthly TF. The upside goal is the resistance level which corresponds to the level of 0.7005 – the upper line of the Bollinger Bands indicator on the monthly time frame.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română