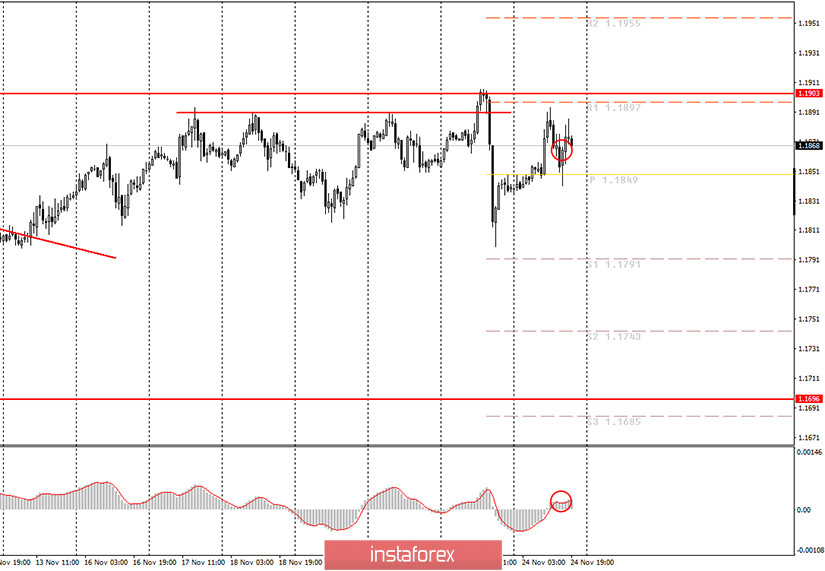

Hourly chart of the EUR/USD pair

The EUR/USD pair moved up for most of the day on Tuesday. However, it turned down at one point and a sell signal appeared (circled in red). Therefore, novice traders had a reason to open short positions today. Unfortunately, the signal turned out to be false, and traders could lose up to 20 points, as the upward movement resumed in the afternoon. At the end of the day, we can say that the price returned to the upper border of the 1.1700-1.1900 horizontal channel. Starting from November 17, the pair's quotes are in close proximity to this line, so it seems that buyers will push this level. However, the price will remain inside the horizontal channel until they do so, which means there are much more chances of a downward movement towards the lower border of the 1.1700 channel. Unfortunately, there is no trendline or trend channel right now to determine the current short-term trend. Better yet, there is now a vague flat inside the flat, since the price has also been trading in a narrow price range for the last week.

No major macroeconomic reports or events in both the UK and the US on Tuesday. There was some information that novice traders probably paid attention to. For example, the process of transfer of power from Donald Trump to Joe Biden has begun in America, which significantly reduces the likelihood of political chaos that has been observed in recent months. There is also news that vaccination of the US population may begin as early as next month, however, given the number of daily recorded cases of COVID-2019, this information does not support the dollar.

No important news scheduled for Wednesday in the European Union, but several rather important reports will be published in the US. The most important among them, from our point of view, is the report on orders for durable goods in four variations (main indicator, indicator excluding defense orders, indicator excluding transport, indicator excluding defense and aviation orders). If the real numbers turn out to be very different from the forecasted ones, then traders can react to them. But most likely, traders will not be surprised by the GDP indicator, since this is already the third GDP publication in the third quarter and, if there are no surprises, the indicator value will be + 33.1% q/q. If there is more, the dollar will receive support. Less - the euro will receive support. The rest of the indicators are less important and will be in the shadow of the above reports.

Possible scenarios for November 25:

1) Long positions are currently irrelevant. Buyers tried to take the pair above the 1.1903 level, but they did not succeed, which means that it is not recommended to buy the euro right now. You are still advised to wait for a new upward trend or go beyond the 1.1903 level in order to open long positions.

2) Trading for a fall at this time remains relevant, since the trend changed to a downward one a few days ago. We advise you to wait for a new sell signal from the MACD indicator and trade down with targets at the support levels of 1.1849 and 1.1791. The MACD indicator is above the zero level, therefore it is sufficiently discharged.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română