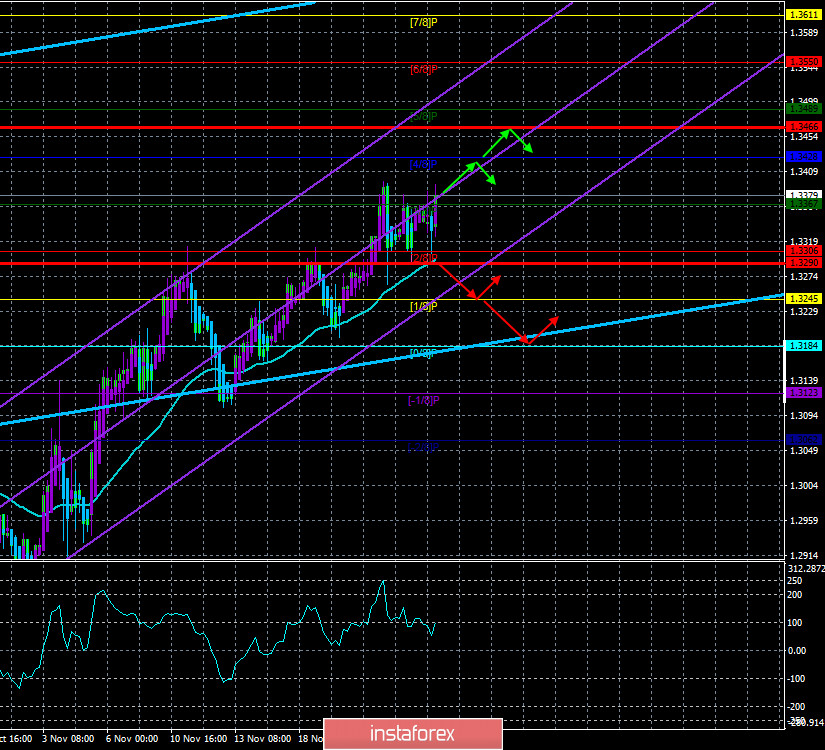

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 116.1402

The situation is even more fun with the British pound. We have repeatedly said that there is no reason for the British currency to strengthen against the US dollar. If the European economy shrank by 11% in the second quarter due to the pandemic, the British economy - by more than 20%, and in the third quarter – showed a rather weak recovery. Therefore, if the strengthening of the euro currency after the spring fall can still be justified fundamentally, then the strengthening of the British pound is not. And the most important thing is that the euro currency has not been growing in the last four months, and the pound has already added almost 20 cents since the spring. Based on what, if no positive messages come from the UK? One might assume that the problem lies in America and the weakness of the US currency. However, no disappointing news has been coming from America lately either. Moreover, both the British and European economies were quarantined at the end of 2020, unlike the American one. That is, in the fourth quarter, traders will be entitled to expect a reduction in the GDP of Britain and the EU, but the US GDP should continue to recover from the crisis. Indirectly, this assumption has already been confirmed by the indices of business activity in the services sector for November. In the UK, Germany and the EU fell below 50.0, while in the United States, on the contrary, they rose. Thus, why the US currency is falling is one of the main mysteries of the second half of 2020.

The most important thing is that the British economy is already in a serious crisis, all government actions are ineffective and questionable in the long term. There was no trade agreement with the European Union. All attempts by the British government to offset the possible damage from the lack of a deal with Brussels with trade agreements with other countries cause only bitter laughter. Andrew Bailey has been sounding the alarm for several months and says that the lack of an agreement with the EU is much worse than the "coronavirus" pandemic. UK businesses continue to leave the Foggy Albion, and those who cannot do so are already begging Boris Johnson to sign an agreement with the EU. These are the realities in which the pound continues to grow.

During 2020, it became known that the UK has concluded two trade agreements. With Canada (temporary) for $ 27 billion and with Japan for $ 1.5 billion. Now pay attention. The total trade turnover with the European Union is 900 billion dollars. The losses to Britain's car industry alone will amount to hundreds of billions of dollars if there is no agreement. Thus, trade deals with Canada and Japan look as simple as signing an agreement for the supply of two bags of potatoes. They will not be of serious significance to the British economy.

Meanwhile, the parties are still trying to find solutions to the most complex and controversial issues, however, they also continue to say that they are ready for a "hard" Brexit if anything happens. This is regularly stated by representatives of the European Union, these words, like a mantra, are constantly repeated by Boris Johnson. Each side is afraid to show that the trade agreement is really important to them, because in this case, the other side may demand more concessions. However, the fact remains that the 900-billion agreement is necessary for both the first and the second. Yes, the impact on the European economy will be smaller in percentage terms. However, it is unlikely that the EU wants to lose several hundred billion dollars. European Commission President Ursula von der Leyen said: "The next few days will be crucial in the negotiations. But I still can't say if there will be an agreement. The EU is well prepared for a "no-deal" scenario, but we prefer "with a deal". I have complete confidence in Michel Barnier. However, whatever the outcome, there must and will be a clear difference between full membership in the EU and the status of just a respected partner." But then Ms. von der Leyen "pleased" traders with a list of issues where serious differences remain. And the list was much broader than many media outlets had imagined in recent weeks. In addition to the issues of fishing, fair competition, and dispute resolution in the courts, von der Leyen also called issues of state aid, labor market standards and social rights, environmental protection, and climate change issues where there is a lack of full understanding. Thus, how the delegations of Michel Barnier and David Frost are going to agree on such a huge number of issues within a few days, and even in video mode, is completely unclear.

And almost immediately after this speech, the head of the European Commission commented on the chief negotiator from the EU, Michel Barnier, who said that if London does not make concessions within the next 48 hours, the European Union will withdraw from the negotiations this week. I don't know if it's just this week or not at all. Thus, the British economy and the pound have been walking on the edge of a precipice in recent months. They have been walking for quite a long time and holding the handle. If one of them falls, the other one will also be dragged down. And most importantly. We have listed a bunch of different speeches, messages from people who have a huge impact on the negotiation process, on the economy of the EU and the UK. And there was not a single message or news that suggested a deal was possible and that Britain's economy would not collapse in 2021. In other words, there is no positive news in principle. Nevertheless, the pound continues to grow steadily.

Based on all of the above, we can only draw one conclusion. Sooner or later, the pound will still start to fall. It is better to be prepared for this. The British currency already looks quite overbought. And when we begin to analyze the reasons for its growth, it generally becomes unclear why market participants continue to buy this currency. However, as we have said many times, the fundamental background can be anything, including the current one, but if traders do not trade according to it, it is meaningless. Therefore, in any case, to expect a fall in the pound and work it out, we need technical grounds to assume such a scenario.

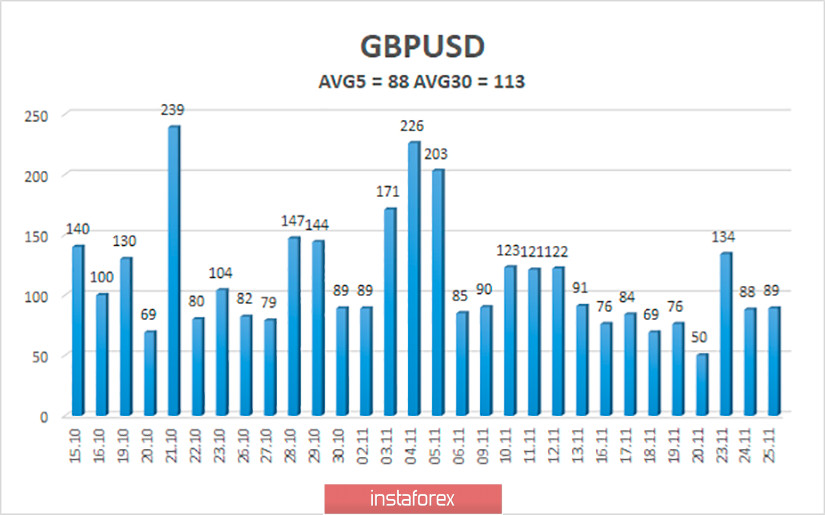

The average volatility of the GBP/USD pair is currently 88 points per day. For the pound/dollar pair, this value is "average". On Thursday, November 26, thus, we expect movement inside the channel, limited by the levels of 1.3290 and 1.3466. A reversal of the Heiken Ashi indicator downwards signals a round of corrective movement.

Nearest support levels:

S1 – 1.3367

S2 – 1.3306

S3 – 1.3245

Nearest resistance levels:

R1 – 1.3428

R2 – 1.3489

R3 – 1.3550

Trading recommendations:

The GBP/USD pair is trying to resume its upward movement on the 4-hour timeframe. Thus, today it is recommended to keep open long positions with targets of 1.3428 and 1.3466 until the Heiken Ashi indicator turns down. It is recommended to trade the pair down with targets of 1.3245 and 1.3184 if the price is fixed below the moving average line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română