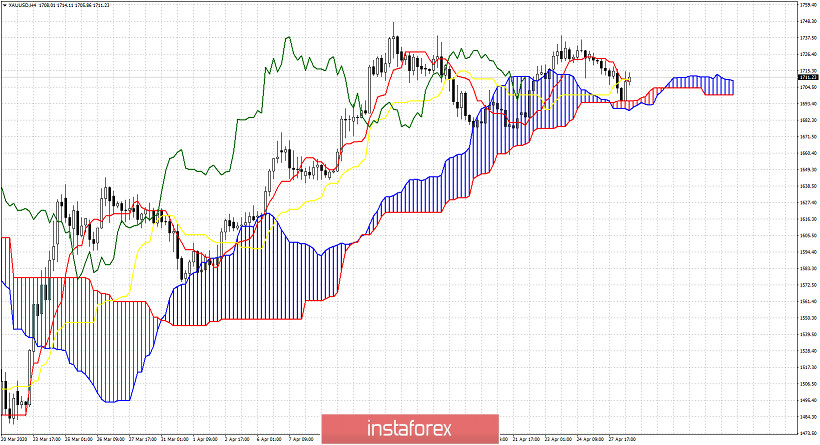

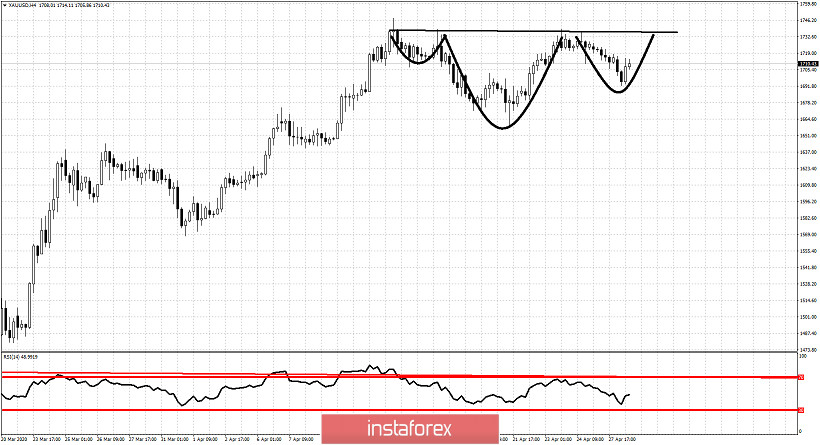

Gold price is challenging short-term Ichimoku cloud support and so far bulls remain in control of the trend. Gold price pulled back towards $1,690 and is now bouncing back above $1,700. Gold price remains vulnerable to a deeper decline but we should not ignore the bullish Head and Shoulders pattern we mentioned in our last analysis.

On the other hand we might be forming a right hand shoulder as we mentioned in yesterday's analysis. If price manages to break above $1,737 we should see a strong move higher to new 2020 highs. If however price breaks below today's lows, we should be very confident that a top is in. Gold remains vulnerable to a big decline towards $1,600. I do not give many chances of this up trend to stay valid for much longer.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română