The dominant topics in the markets remain the approaching date of the Fed meeting, which will start the cycle of monetary policy tightening, as well as geopolitical tensions around Ukraine, which are escalated with a not entirely clear goal, but which has quite definite consequences.

U.S. President Joe Biden is convinced that Russia will invade Ukraine in the coming days. Since the Russian leadership denies the preparation of such an invasion, it can be assumed that in the coming days there will be a large-scale provocation that will change the geopolitical picture on the European continent.

Stock markets in the U.S. and Europe closed on Friday in negative territory, but the Asia-Pacific countries, contrary to expectations, are trading in different directions, that is, the risks of rising tensions are not considered high by the players.

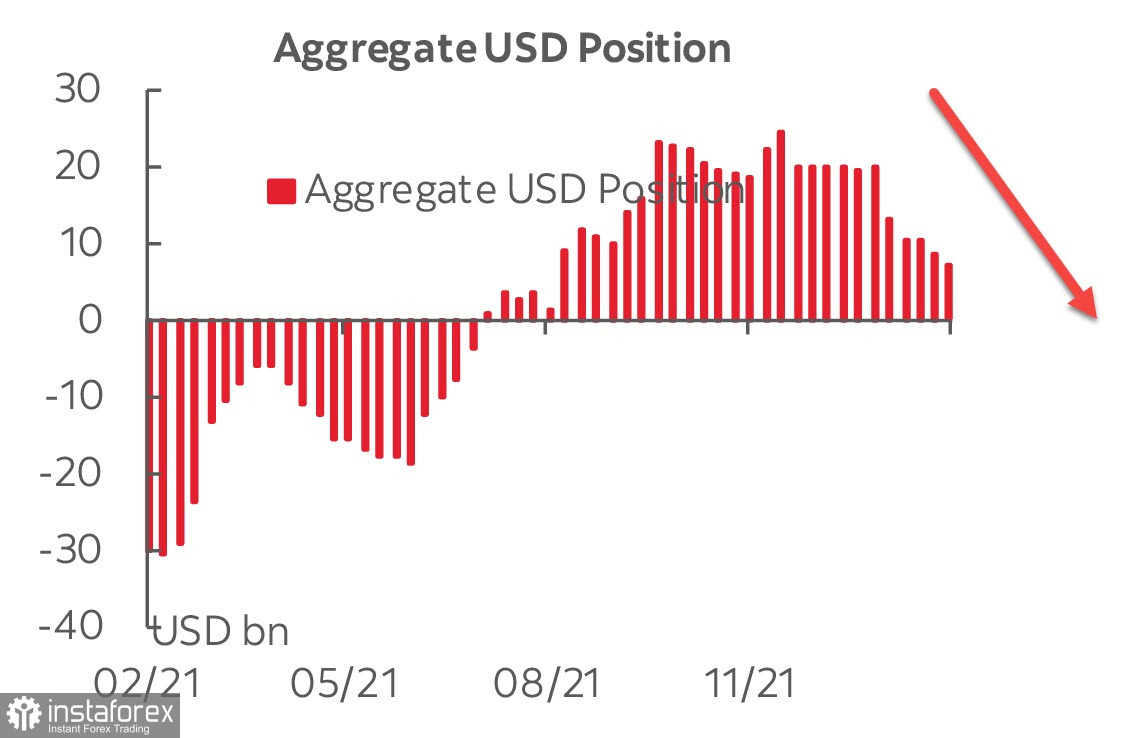

Weekly data from the CFTC reflects a further weakening of bullish sentiment on the U.S. dollar, the cumulative long position fell by 1.301 billion over the reporting week, to 7.164 billion, the lowest since August 2021.

New York Fed President John Williams is ready to start a rate hike cycle, but sees no reason to start immediately with +0.5%. Governor Lael Brainard is set for 7 raises this year, while Chicago Fed President Charles Evans confirmed the general mood, but without any specifics. The upcoming speech of Fed Chair Jerome Powell in Congress on March 2 and 3, where he will present a semi-annual report on monetary policy, should be considered key events. Unless, of course, information about the results of these hearings goes to the media in full.

We assume that the dollar will remain under slight pressure today, but activity will be reduced as banks in the U.S. are closed due to the celebration of Presidents Day.

EURUSD

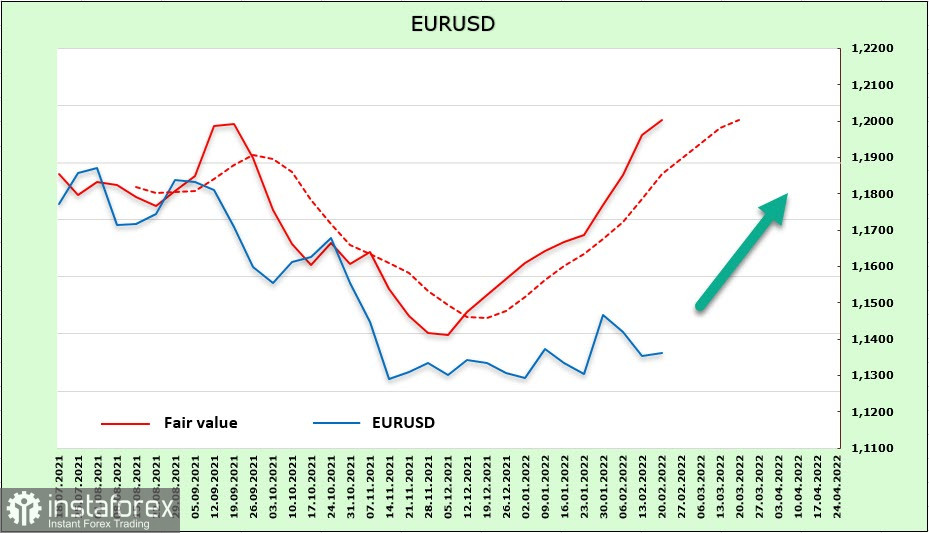

Inflationary pressure in the euro area continues to grow. Producer prices in Germany rose in January by 2.2% (1.5% forecast), an annual increase of +25%, which is extremely high, and there is no doubt that part of this growth will pass to consumer inflation. Resolution of the supply chain crisis is not expected until the summer, but today attention will be directed to the PMI reports. If the reports show a good recovery in business activity, it will increase the chances that the ECB will begin to normalize monetary policy "sooner rather than later" and will increase demand for the euro.

The net long position on the euro rose during the reporting week by 1.214, reaching 6.756 billion, the highest since August. The escalation of geopolitical tensions in Europe has not yet yielded results, the settlement price continues to rise, which means a general bullish mood for the euro, the implementation of which is still blocked.

The euro is trying to realize the bullish mood, the support of 1.1309 still resisted, we assume that attempts to rise higher will continue. The nearest target is the channel border 1.1440/50, then 1.1480/1500.

GBPUSD

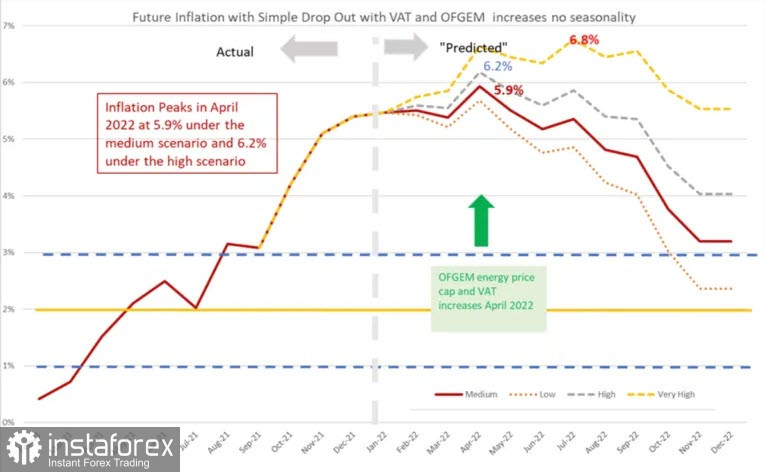

Retail sales in January rose by 1.9%, or 9.1% YoY, both figures are higher than expected and reinforce the growth of inflationary expectations. NIESR analysts suggest that inflation will peak in April 2022 in the range of 5.9%-6.2%, but they do not exclude that inflation may rise to 7% and stay close to this level until October.

There are no changes in the position of the Bank of England yet. On Wednesday, BoE Governor Andrew Bailey will speak in the UK Parliament and, most likely, will announce something specific, after which the markets may change their forecasts for the rate. In the meantime, we proceed from the fact that the hawkish scenario remains the dominant one, and the pound, accordingly, has some advantage over the dollar.

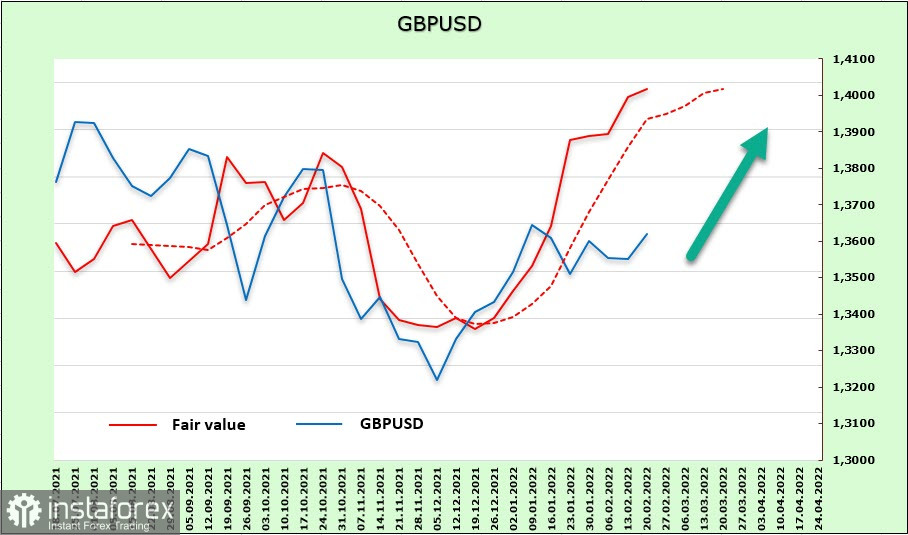

The weekly change in the pound is +913 million, a bullish position of +189 million has been formed again, the overbalance is minimal, we can rather talk about neutral positioning. At the same time, the settlement price continues to move north, as there is an increased demand in the UK stock market, which forms the demand for the pound. The settlement price is above the current spot and above the long-term average, which gives grounds to expect continued growth.

The pound is making attempts to resume growth, we assume that the target of 1.3750 will be reached in the very near future, then the target of 1.3830/40.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română