The increased volatility of the markets persists on Wednesday. Ukraine President Volodymyr Zelenskiy's announcement that Ukraine does not aspire to join NATO "in the near future" and a willingness to discuss the status of the two breakaway republics led to a small burst of positiveness, but not for long. As soon as U.S. President Joe Biden announced that the U.S. would ban Russian energy imports, commodities surged again, and stock indices returned to the red zone.

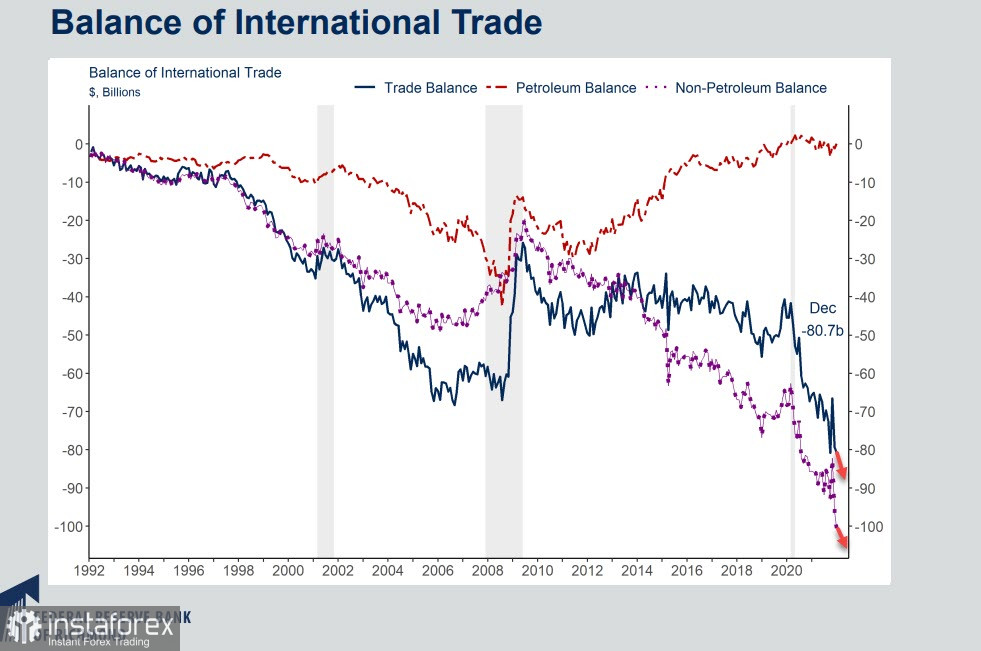

The U.S. trade balance continues to fall into the abyss, in January the deficit grew from 82 billion to 89.7 billion, and it must be assumed that the next round of the sanctions war will not contribute to its improvement.

On Thursday, the report on U.S. inflation for February will be published, the forecast is already 7.9%, and, perhaps, the real result will cover it, given the extreme rise in gasoline prices. As the date of the Fed meeting approaches, there are more and more questions, since rising inflation requires action, and a slowdown in economic growth requires exactly the opposite action. The threat of stagflation is getting closer.

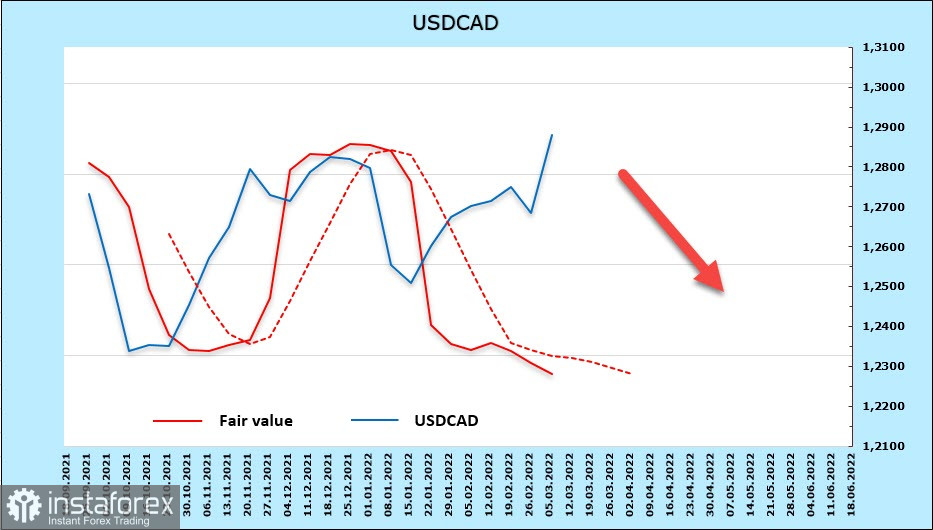

USDCAD

The Bank of Canada, as expected, began to normalize monetary policy, raising the key rate by 0.25% to 0.5%. The decision by the bank comes immediately after the release of economic data for the fourth quarter of 2021, which showed that the Canadian economy grew by 6.7% year-on-year for the quarter and 4.6% year-on-year as a whole. Growth was provided by the manufacturing sector, which essentially pulled up positive data on GDP even against the backdrop of relatively low household spending and a slowdown in purchases.

Bank of Canada Governor Tiff Macklem noted at the final press conference that the beginning of the increase cycle will allow to influence the internal causes of inflation, but as for external causes, the bank's capabilities are extremely limited here.

In addition to the rate hike, the BoC will begin normalizing its balance sheet, which has ballooned to over 20% of GDP as a result of large-scale purchases of T-bills. The whole process of balance reduction takes about two years. Overall, we can say that the meeting of the BoC is confidently bullish for the loonie.

The net long position on CAD has grown again, the weekly change is +385 million, the bullish preponderance is +1.11 billion, the estimated price is steadily going down.

The macroeconomic picture is generally in favor of the CAD, but geopolitical tensions seem to be more significant now, and even the explosive growth in commodity prices does not help the Canadian dollar. Breakout from the converging triangle upwards makes the target 1.2950/60 relevant, then 1.3020. At the same time, one must assume that the fundamental picture is in favor of the CAD, so a decrease in escalation will quickly lead to a downward turn of USDCAD.

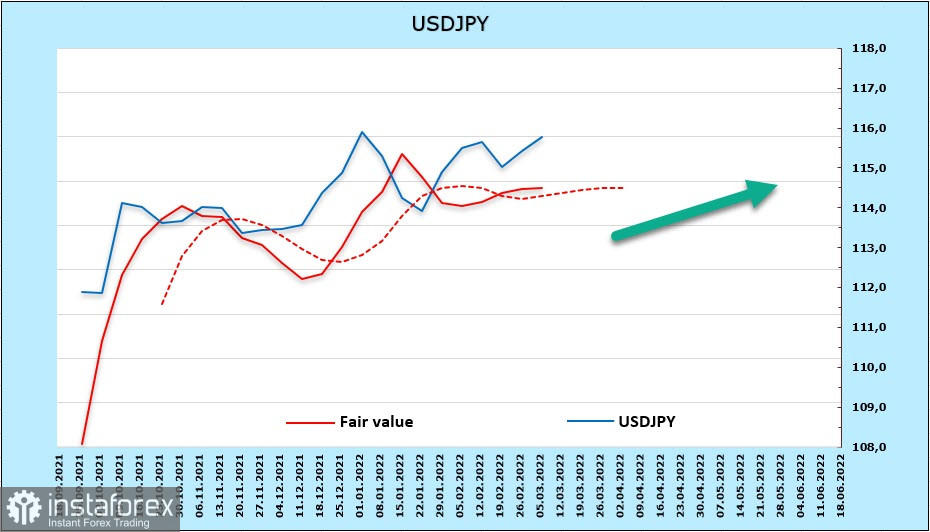

USD/JPY

On March 9, the Cabinet of Ministers of Japan published the second preliminary estimate of GDP for the 4th quarter, real GDP growth was revised down by 1.3%. If we compare GDP growth rates with the pre-pandemic year 2019, then the dynamics is the same in 2020. GDP fell by 4.5%, so the growth is 4.6% from 2020 means only a return to the level of the previous year, that is, the Japanese economy is a weakly growing economy.

The balance of payments deficit rose sharply to 1.11 trillion yen, this is the worst figure since March 2014. Obviously, if the madness in the commodity markets continues, and there is no reason to expect improvement in general, then the balance of payments will go further down, and the yen will continue to weaken. It is clear that under such conditions, one should not expect any actions from the Bank of Japan to normalize monetary policy.

The net short position for the reporting week rose again to 7.476 billion, a significant bearish margin. The settlement price is above the long-term average.

The forecast of a possible decline in USDJPY did not come true; as of the morning of March 9, there is a slight bullish preponderance. We assume that in the near future there will be an attempt to pass the resistance 116.35, however, there are no special reasons for a strong movement.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română