The pound/dollar pair is falling, updating more and more new price lows. Today, the GBP/USD bears made another price breakthrough, falling to the base of the 27th figure. The pair was last in this price area in the fall of 2020. The general flight from risks, weak macroeconomic reports in the UK, the growth of hawkish expectations about the Fed's further actions, geopolitical tensions - all these circumstances push the pair down to new price anti-records.

At the end of last week, sellers overcame the powerful and "impregnable" support level of 1.3000. Before that, they tested this price line for several days, but each time they could not gain a foothold in the area of the 29th figure. However, on Friday, the market was marked by another dollar rally, after which the pound rolled down again, overcoming more than 300 points in two trading days. Jerome Powell's hawkish attitude, which he demonstrated during his last speech (last Thursday), was another indication that the Fed intends to aggressively tighten monetary policy. A 50-point rate hike at the May meeting is a matter that can be said to have been resolved. There is also a high probability of a 50-point increase following the results of the June meeting. It is too early to talk about further prospects, but it is safe to say that each subsequent meeting this year will be marked by an increase in the interest rate. The only question is by what amount - 25 or 50 basis points.

Against the background of such hawkish impulses, the Bank of England looks very pale. There are more and more suggestions on the market that the English regulator will disappoint traders at the May meeting (which will take place next week), as it will take a wait-and-see position. In particular, the currency strategists of the Canadian Scotiabank warned their clients about the high probability of this scenario. According to them, several signs at once indicate a weakening of the hawkish position of the British Central Bank. Firstly, it is the indecisive rhetoric of the members of the Bank of England, and secondly, the rather weak macroeconomic reports that have been published over the past 4 to 5 weeks.

The head of the English regulator, Andrew Bailey, really "does not shine with optimism." In one of his speeches, he de facto questioned the expediency of raising the interest rate at the May meeting. Bailey has repeatedly pointed to the "unstable situation" that has developed in the UK and beyond. After such words, the idea began to sound more and more often among analysts that the English regulator could take a wait-and-see position at the next meeting. By the way, the Bank of England Committee did not demonstrate solidity at the March meeting either - as you know, John Cunliffe then voted against raising the rate. It can be assumed that following the results of the May meeting, there will be more "dissidents".

The UK's macroeconomic reports also leave much to be desired. Naturally, except for inflation, which continues to update records. The rest of the releases, to put it mildly, "raise questions."

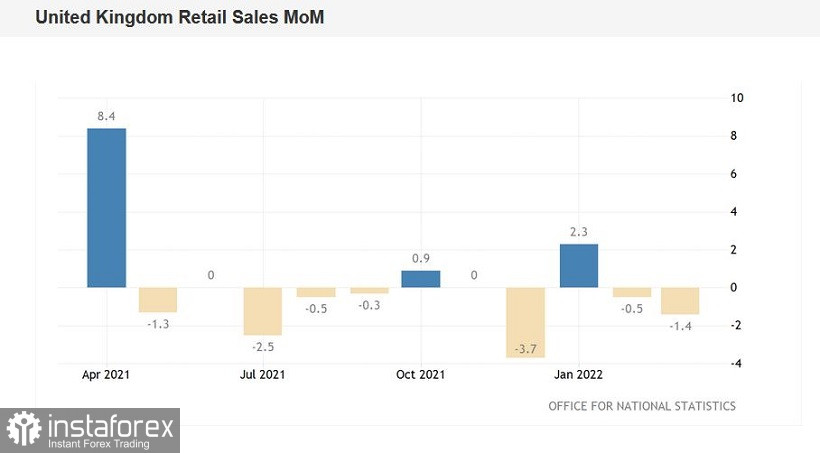

For example, the latest data on retail sales in the UK last week came out in the red zone - both taking into account fuel costs and without this component. Thus, the volume of retail trade, taking into account fuel costs, remained in the negative area, reflecting a decrease in consumer activity. With a forecast of growth of 0.2%, the indicator collapsed to -1.4%. A similar situation has developed with the "related" component: the volume of retail trade excluding fuel costs in March decreased (-1.1%) with a growth forecast of 0.4%.

The data on the growth of the British economy published in early April also disappointed. On a monthly basis, the volume of GDP in February increased by only 0.1% (in January, an increase to 0.8% was recorded). According to most experts, the growth should have been more impressive, so this component came out in the "red zone".

Thus, the GBP/USD pair retains the potential for its further decline. The increased demand for the US currency is due not only to the hawkish mood of the Fed but also to the growth of anti-risk sentiment. The "Ukrainian case", the "Taiwan issue" and the outbreak of coronavirus in China - these "three whales" keep the safe dollar in the context of risk flight. Therefore, it is advisable to use corrective pullbacks for the pair as an excuse to enter into sales. The pound is not yet able to reverse the situation, while the greenback is only gaining momentum throughout the market.

From the point of view of technology, the pair on the D1 timeframe is located on the lower line of the Bollinger Bands indicator, as well as under all the lines of the Ichimoku indicator, which shows a bearish "Line Parade" signal. All these signals of a technical nature also indicate the priority of the downward movement. The first, and so far the main target of the southern trend is located at 1.2670 - this is the lower limit of the Kumo cloud on the weekly chart. If the GBP/USD bears gain a foothold below this target, they will open their way to the base of the 26th figure.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română