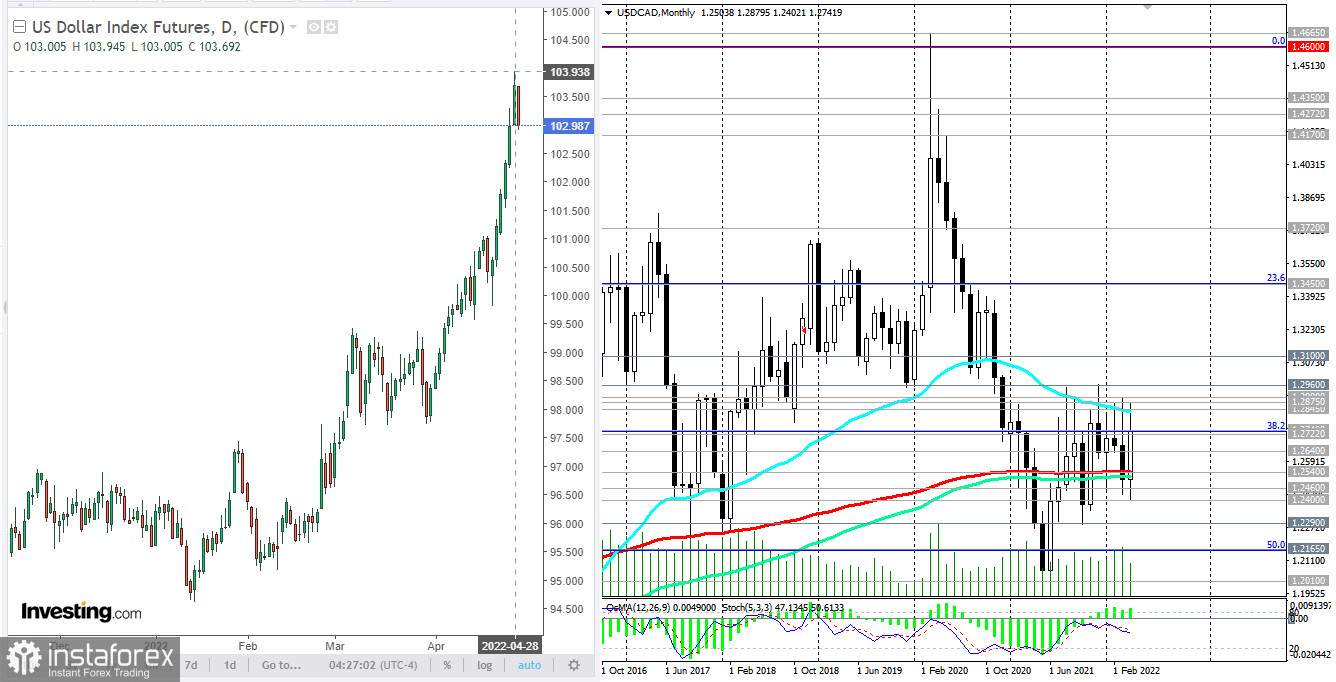

Having reached a new 2-year high of 103.94 on Thursday, the DXY dollar index is declining today. As of this writing, DXY futures are trading 100 pips lower near 102.94.

The dollar began to gradually weaken on Thursday, after the publication of data on US GDP. According to the Bureau of Economic Analysis, a preliminary estimate indicated a decline in GDP in the 1st quarter (1.4% against the forecast for growth of 1.1% and after growth in the 4th quarter of 2021 by 6.9%). GDP data is one of the key data (along with labor market and inflation data) for the Fed in terms of its monetary policy, and the weaker estimate is likely to alert market participants to the Fed's determination to pursue a tighter monetary policy.

At the same time, the Fed's preferred personal consumption expenditure price index and the GDP price index (for the 1st quarter) came out with an increase in indicators, and above the forecast: 7% and 8%, respectively, against 6.4% and 7.1% in the previous quarter. The data once again indicate that the Fed is in a difficult situation – to cope with accelerating inflation without harming, at the same time, the economic recovery.

Today, on the last trading day of the week and month, investors will pay attention to the publication at 12:30 and 14:00 (GMT) of another block of important macro statistics for the United States, among which is the core personal consumption expenditure price index (PCE) for April (Fed uses the annual core PCE price index as the main indicator of inflation) and the final estimate of the University of Michigan consumer confidence index. This indicator reflects the confidence of American consumers in the economic development of the country. A high level indicates growth in the economy, while a low level indicates stagnation. The preliminary estimate was 65.7 (after 59.4 in March, 62.8 in February, 67.2 in January 2022, 70.6 in December, 67.4 in November, 71.7 in October, and 72.8 in September 2021). The final score is 62.0, which may also have a negative impact on the dollar.

Also at 12:30 (GMT), Statistics Canada is to release its February GDP report. GDP is considered an indicator of the overall health of the Canadian economy, and is expected to grow by 0.8% (from 0.1% in December and 0.2% in January). The relative growth of the indicator may support the quotes of the Canadian dollar, including in the USD/CAD pair.

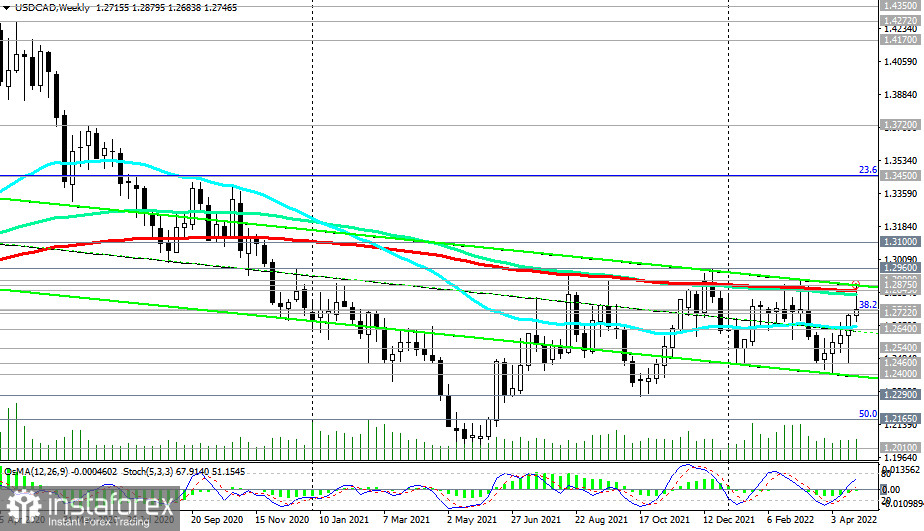

Today, against the backdrop of a weakening USD, the USD/CAD pair is declining, trading near the 1.2745 mark as of this writing.

Overall, it can be said that USD/CAD is trying to fully restore the long-term trend, strengthening from the lows near 1.2000, reached in May 2021.

Above the 1.2540 support level, it is still a bull market. A breakout of USD/CAD into the zone above the resistance level of 1.2845 will mean the final completion of the downward correction and exit, so to speak, "to operational space" for further growth.

However, there are also nuances here. As you know, in April, the Bank of Canada decided to raise the interest rate by 0.50% (to 1.0%), which is a positive factor for CAD, which, by the way, is included in the basket of 6 major currencies of the dollar index (DXY), amounting to approximately 9.1% (the euro accounts for 57.6%).

"With the economy moving into excess demand and inflation persisting well above target, the governing council judges that interest rates will need to rise further," the BOC said, adding that the timing and pace of further interest rate hikes will depend on incoming economic data.

Inflation in the country accelerated to a thirty-year high. In February 2022, consumer prices in Canada rose by 5.7% in annual terms after rising by 5.1% in January. This is the highest figure since August 1991.

Most economists expect the key interest rate to reach 2% by the end of 2022, compared to expectations of 1.75%-2.0% of the Fed rate by the end of the year, with a 0.25% increase at each meeting.

Thus, the monetary policy parameters of the BOC run almost in parallel with the monetary policy parameters of the Fed. At the same time, inflation in Canada is still less than in the US, and rising oil prices provide strong support to the quotes of the Canadian currency.

Conclusion: the Canadian dollar is a serious competitor to the US dollar, which is likely to be taken into account by long-term investors.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română