Gold prices advanced on Thursday following the release of disappointing real estate market data in the US. The Fed's interest rate hike is pushing buyers out of the market, the National Association of Realtors (NAR) said.

According to NAR's report, existing-home sales fell by 2.4% to a seasonally adjusted rate of 5.61 million, down from 5.75 million in March.

Economists expected sales to decrease to 5.65 million.

Year-over-year, sales declined by 5.9%.

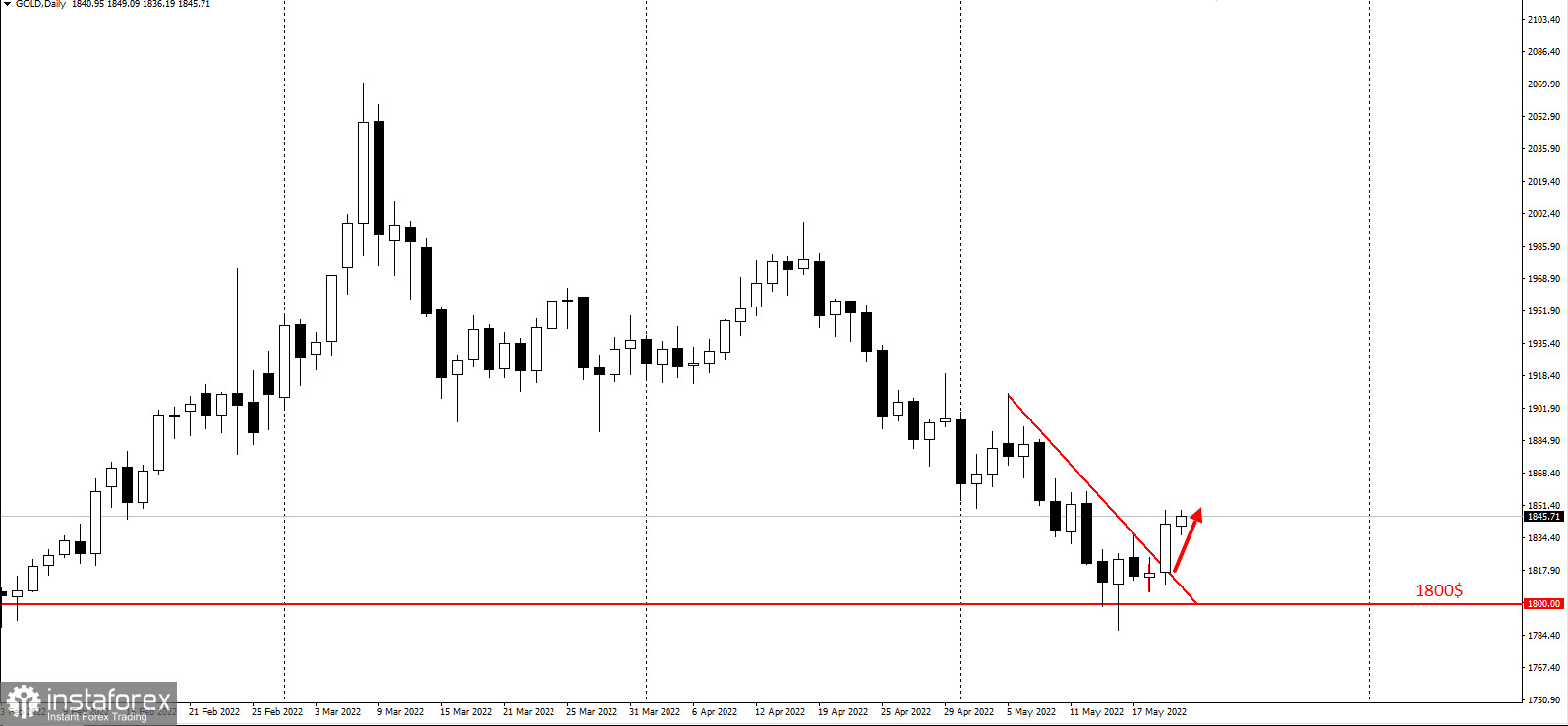

Weak US economic data spurred demand for gold. Yesterday, June gold futures increased by 1.5% to $1,842.40 per ounce.

The Federal Reserve's interest rate increases have also resulted in rising mortgage rates, negatively affecting the real estate market.

"Higher home prices and sharply higher mortgage rates have reduced buyer activity,", NAR's chief economist Lawrence Yun said.

Yun noted that falling sales should increase supply in the market. The inventory of unsold existing homes reached 1,030,000 in April, sitting at a sits at a 2.2-month supply.

"The market is quite unusual as sales are coming down, but listed homes are still selling swiftly, and home prices are much higher than a year ago," Yun said.

According to the report, the median existing-home price for all housing types in April was $391,200, up by 14.8% from $340,700 in April 2021.

Disappointing US economic data are pushing gold prices upwards.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română