Markets so quickly lifted the euro to a monthly high against the US dollar as ECB President Christine Lagarde tried to cool the ardor of the EURUSD bulls with words about a gradual tightening of monetary policy. Lagarde does not think that the eurozone is in a state of a sharp increase in demand. It's definitely supply-fueled inflation. In this regard, the ECB should not rush, and it does not need to panic.

Lagarde's two-day speeches in the regime first muddied the waters, and then she tries to calm the markets, becoming her hallmark. The story of the ECB chief's statement that the regulator should not close spreads on the European debt market is still fresh in memory, followed by an apology on this issue against the backdrop of a rapid rally in eurozone bond yields. History repeated itself in May. At first, Lagarde provoked an attack of the "bulls" on EURUSD with words about the exit of the deposit rate by the end of September from the negative area, and then tried to stop them with a speech about a gradual tightening of monetary policy. Did not work out.

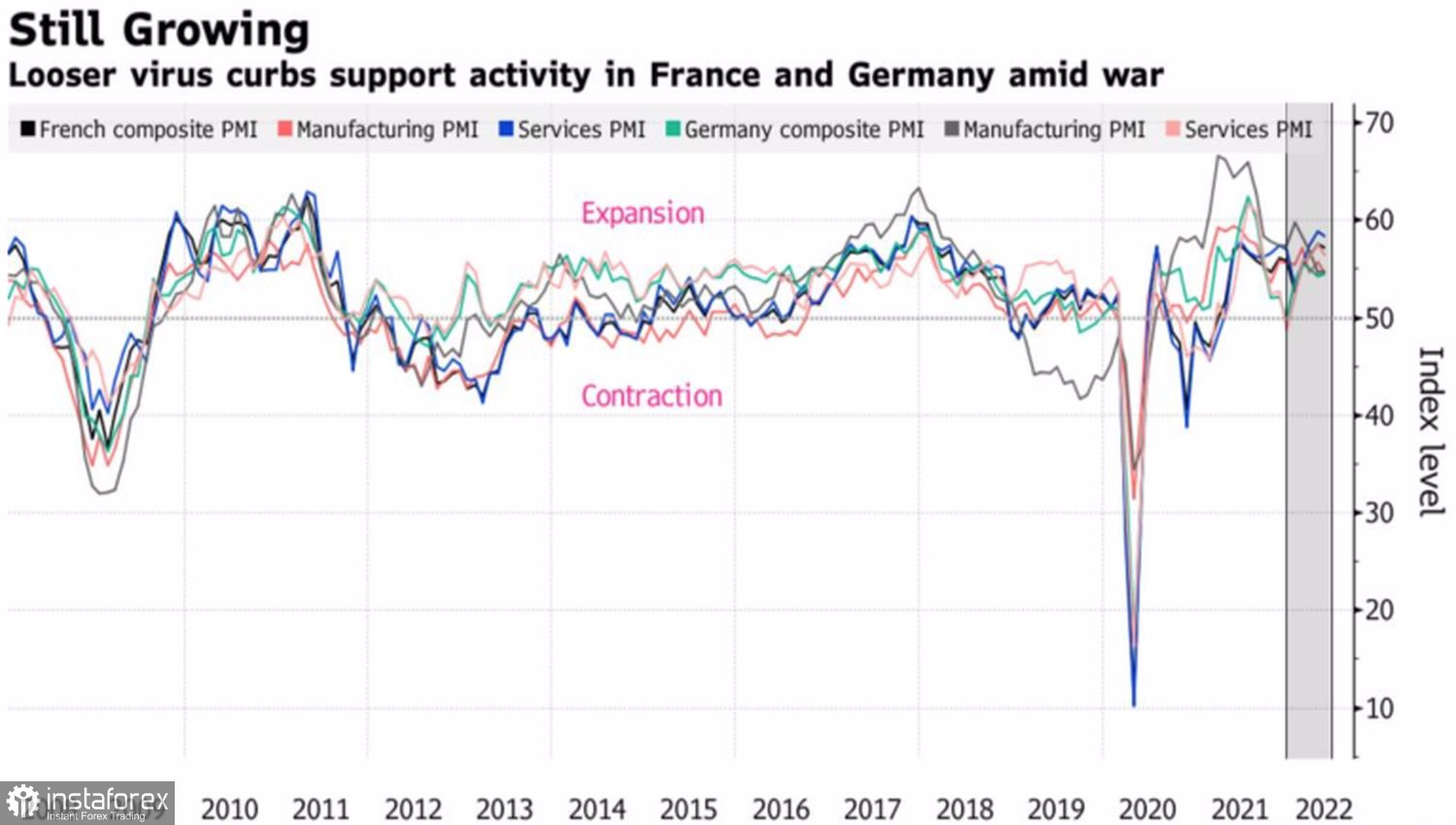

Against the backdrop of pleasant surprises from the German business climate index and business activity in the manufacturing sector, the euro soared above $1.07. Lagarde seemed to have forgotten that one of the trump cards of the "bears" in EURUSD was the expectation of a recession in the eurozone due to the energy crisis and the armed conflict in Ukraine. The head of the ECB argues that the risks of a downturn in the economy of the currency bloc are small, since low unemployment and large savings of the population will allow it to be avoided.

Business dynamics in Germany and France

Lagarde's clear indications of exactly when QE will end, and when and by how much rates will rise, is evidence of a consensus within the Governing Council and a victory for the hawks. The latter, by the way, turned out to be dissatisfied with the exclusion of the possibility of increasing borrowing costs by 50 bps at one of the meetings of the ECB. As a result, Bank of France Governor Francois Villeroy de Galhau had to say that the big step was not part of the consensus.

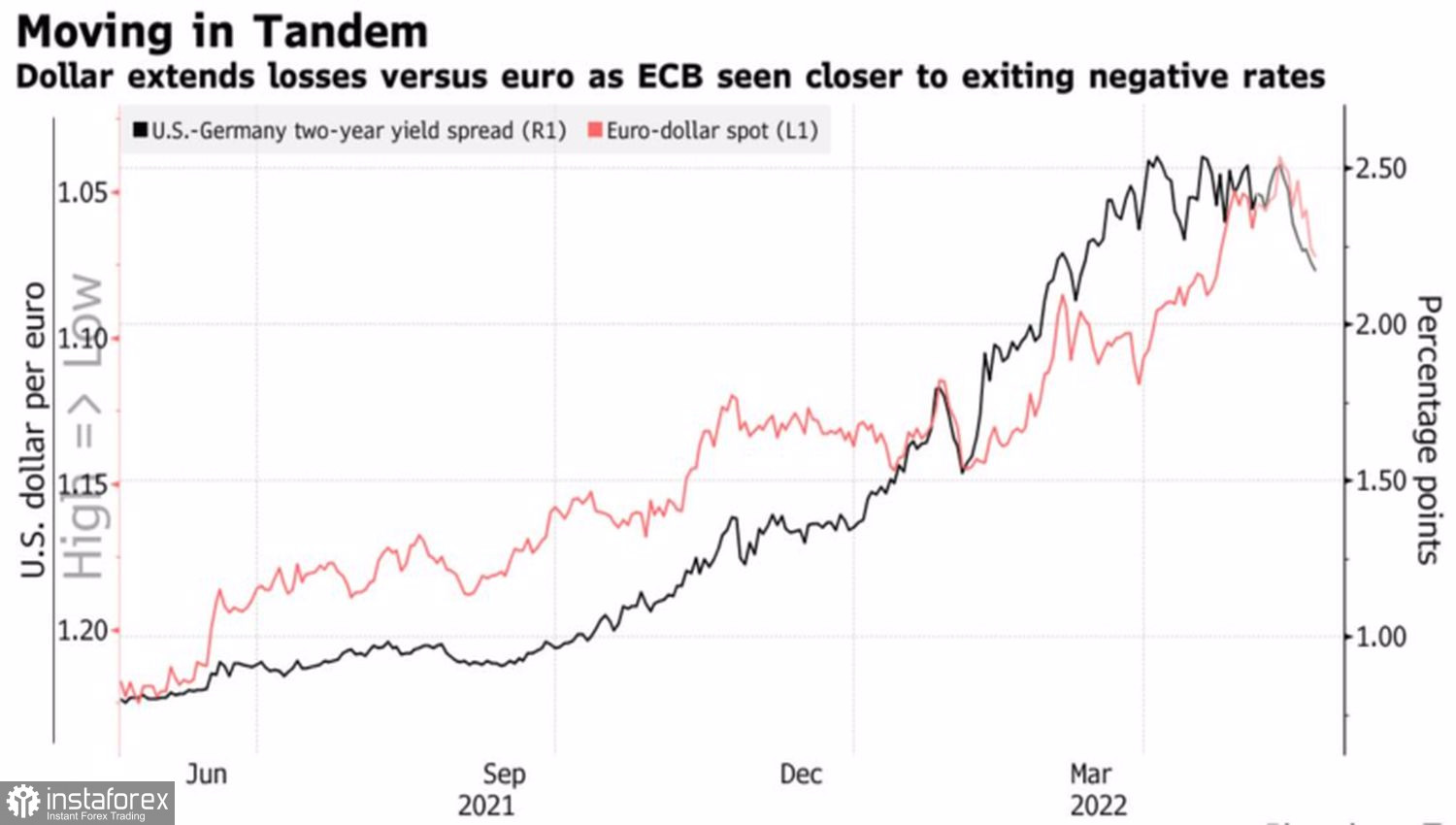

Even though after the fiery speeches of the ECB, money markets still believe that the deposit rate will increase by 110 bps by the end of 2022, German bond yields have risen, and its spread with American peers has narrowed to the lowest levels since early March. This created a tailwind for the EURUSD rally.

Dynamics of EURUSD and the yield differential of US and German bonds

It is obvious that the divergence in the policies of the Fed and the European Central Bank has already been taken into account in the quotes of the main currency pair, while talk of an increase in the rate of monetary restriction by Frankfurt is pushing the euro out of the abyss. Moreover, investors were already tired of buying the US dollar and they needed a reason to start getting rid of it.

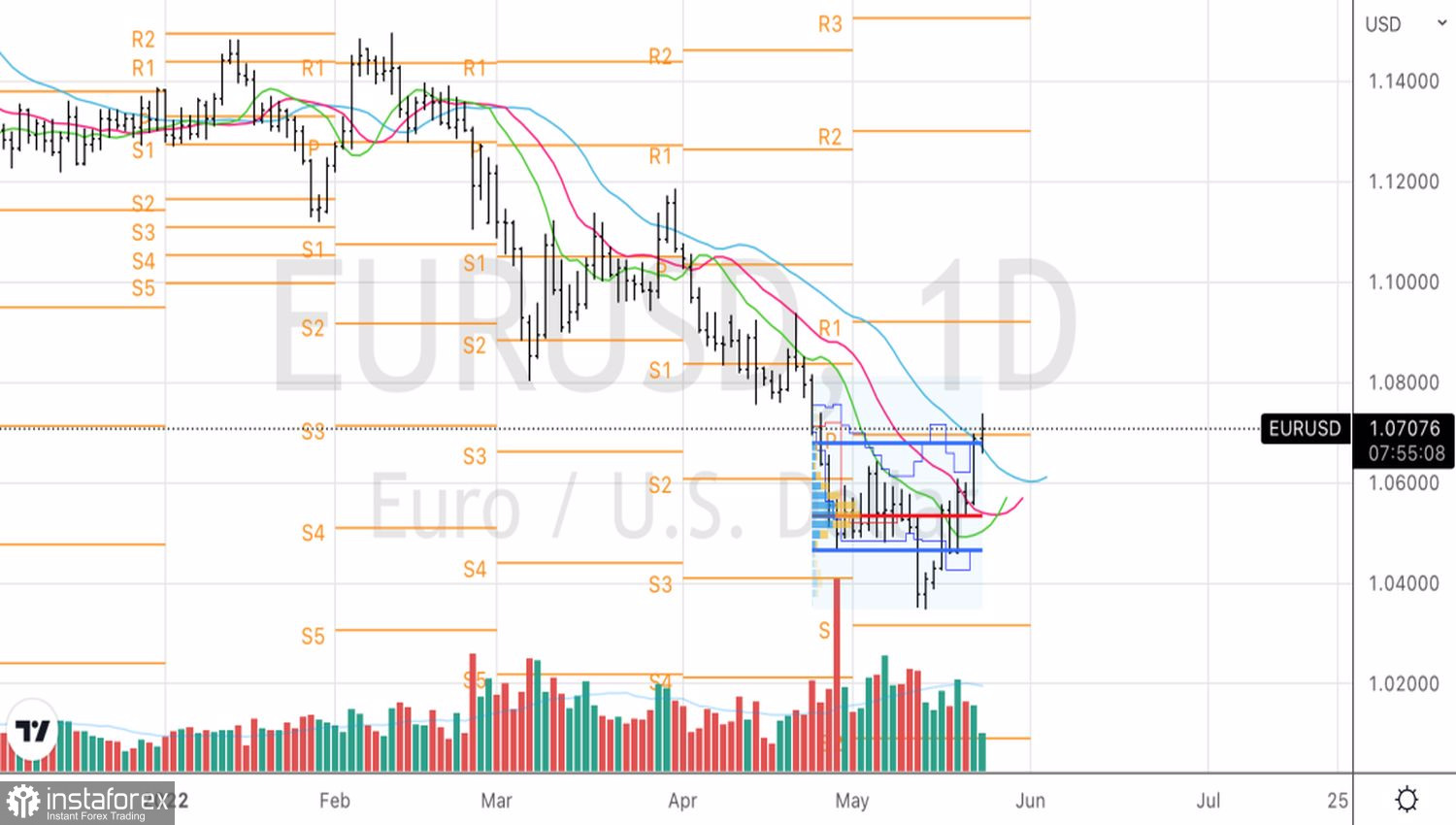

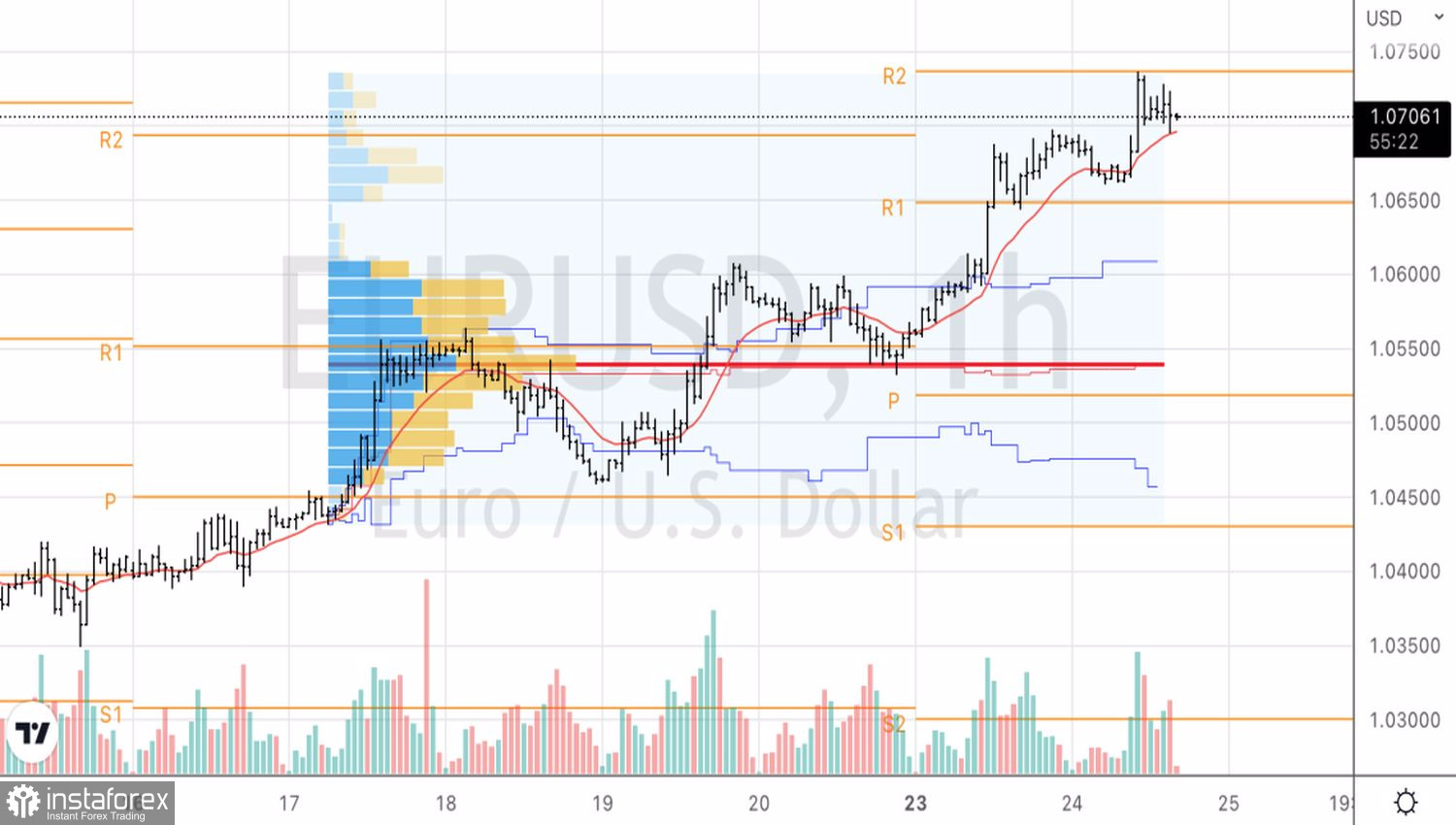

Technically, if the EURUSD bulls manage to gain a foothold above the 1.069 pivot point identified on the daily chart, the rally risks continuing. On the hourly timeframe, a rebound from 1.069 to 1.0695 could be a buying opportunity.

EURUSD, Daily chart

EURUSD, Hourly chart

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română