The fall in the yield of US Treasury bonds against the backdrop of the ongoing collapse of US stock indices means only one thing. Investors began to worry more not about inflation, but about a recession. The fear that the Fed having "the punch bowl removed" will turn into a recession in the economy is so great that hedge funds actively getting rid of gold began to return to purchases. In the week by May 17, their net longs fell by 30% and reached an 8-month low. Is it time to buy a cheaper precious metal?

History shows that of the last 20 Fed tightening cycles, only three have not ended in recessions. At the same time, in most cases, the central bank acted ahead of schedule. In 2022, it catches up with inflation that has run far ahead. Only in 2000 was there something similar to the current situation. And then, a year later, the US economy faced a recession, and the S&P 500 was marked by a three-year bear market with a 60% drawdown at its extreme. Based on previous experience, the soft landing that Jerome Powell is talking about is impossible, so the increase in demand for gold looks natural.

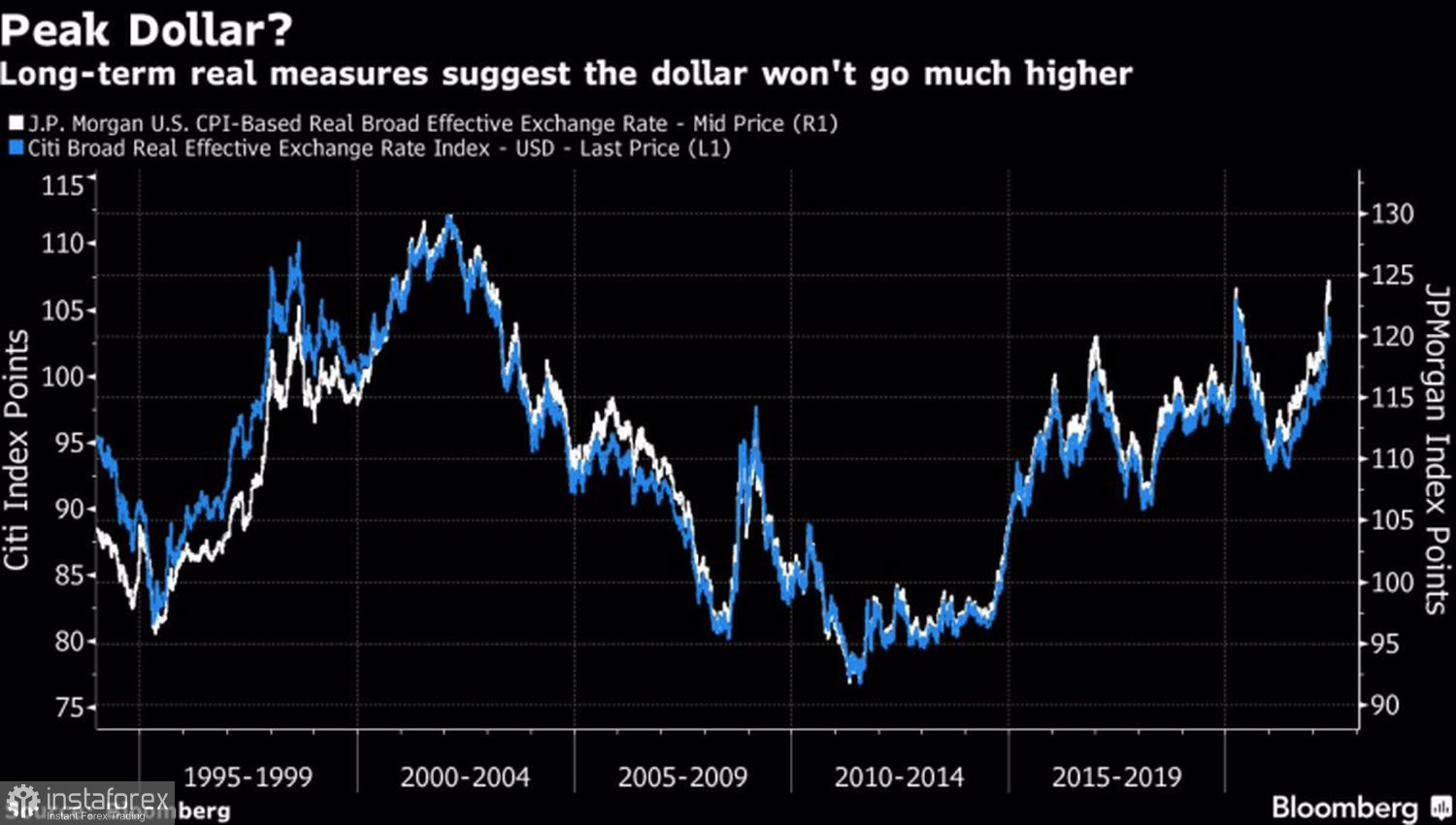

The shift in investor focus from inflation to recession is putting pressure on the US dollar. The negative from the US real estate market and the drop in business activity to a 4-month low only reinforce talk of an approaching recession, which contributes to a decrease in Treasury yields and a peak in the USD index. Especially since the ECB, obviously late to the party on tightening monetary policy, is trying to catch up with the help of verbal interventions. The euro is growing, the dollar is falling, and the XAUUSD bulls are taking advantage of this.

Dynamics of business activity in the USA

Dynamics of the US dollar

Investors seriously thought about the words of Atlanta Fed President Raphael Bostic that the Fed will have to pause the process of monetary restriction in September. What will make the central bank do this? Maintaining inflation at elevated levels? Or the threat of an impending recession? In any case, uncertainty is currently playing into the hands of gold.

What's next? In my opinion, fears about the approaching recession are exaggerated. American household finances are strong and the labor market is stronger than ever. FOMC members are sure that the reduction of GDP for two quarters in a row will be avoided. Their optimism, contained in the minutes of the April FOMC meeting, can significantly change the situation. Stock indices will find ground under their feet, Treasury yields will rise, and the precious metal will again fall into the black body.

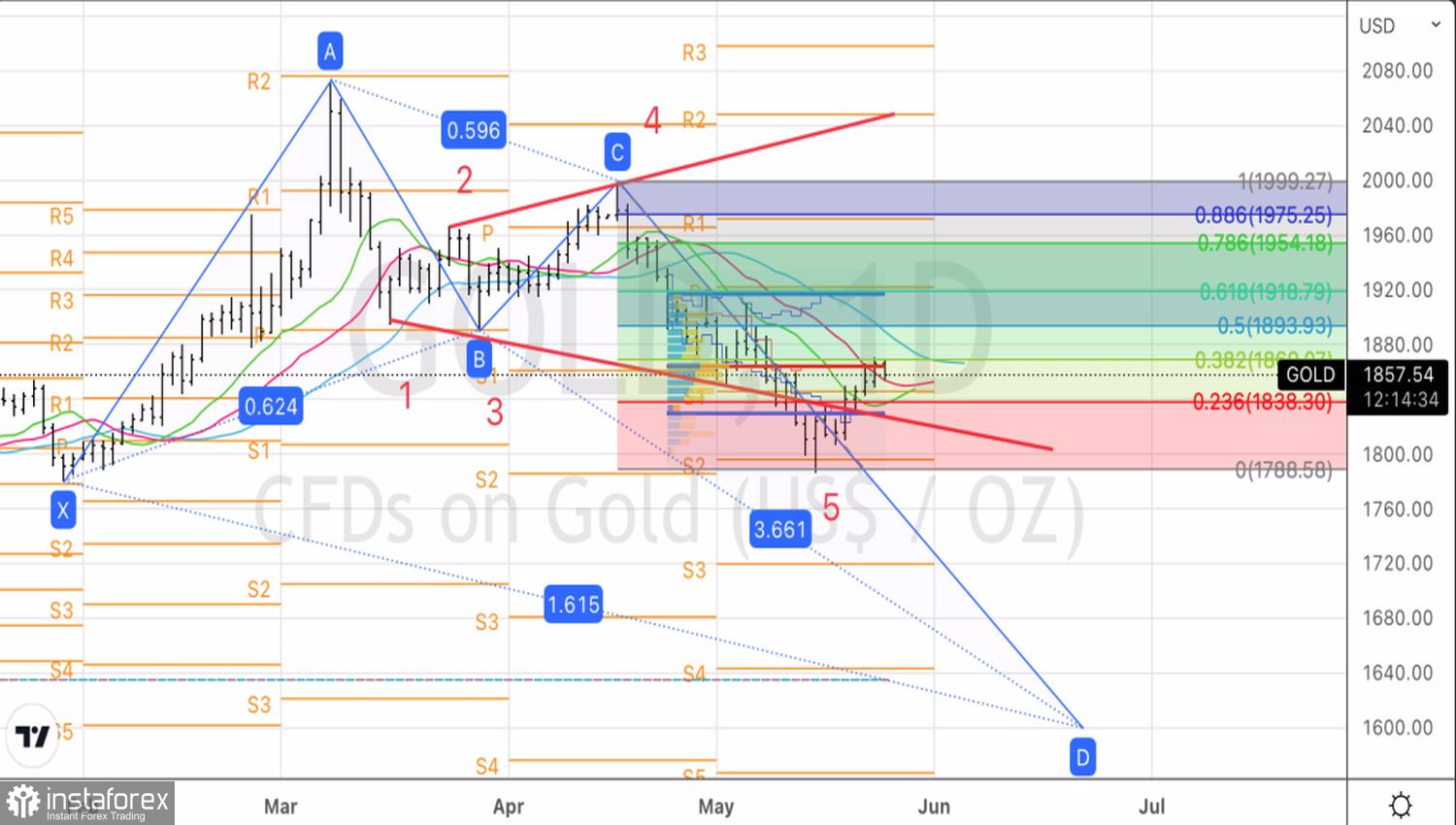

Technically, if we assume that the peak of gold below $1800 per ounce allowed the formation of point 5 of the broadening wedge pattern, then in the future a rebound from the resistance at $1869, or a fall below the support at $1838 per ounce may become the basis for the formation of short positions. The target for the downward movement in the precious metal is still the target of 161.8% according to the Crab harmonic pattern. It is located near $1600 per ounce.

Gold, Daily chart

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română