The Institute for Supply Management (ISM) reported on Wednesday that the US manufacturing PMI unexpectedly rose in May to 56.1 from 55.4 in April, which was also significantly better than the forecast of 54.5. At the same time, the sub-index of new orders rose to 55.1 from 53.5.

The dollar reacted positively to the statistics presented by ISM on the state of the manufacturing sector of the American economy, which forms a significant part of the country's GDP. The day before, data on the index of consumer confidence of Americans (CB Consumer Confidence) were published. Although the indicator for May fell to 106.4 points from 108.6 in April, it was still better than the forecast of 103.9 and suggests that Americans remain optimistic, and consumer confidence remains at high levels, despite high inflation.

Yesterday, US Treasury Secretary Janet Yellen, who previously served as head of the Fed, said that it was a mistake to rely on the temporary nature of the current inflation surge, given the military conflict in Ukraine and the prospect of further growth in energy prices, as well as serious disruptions in supply chains.

On Tuesday, US President Joe Biden met with US Federal Reserve Chairman Jerome Powell. He said that he fully supports the measures taken by the Fed in the fight against high inflation. This was taken by market participants as a signal that the Fed will stick to a tight monetary policy plan, which is a bullish signal for the dollar.

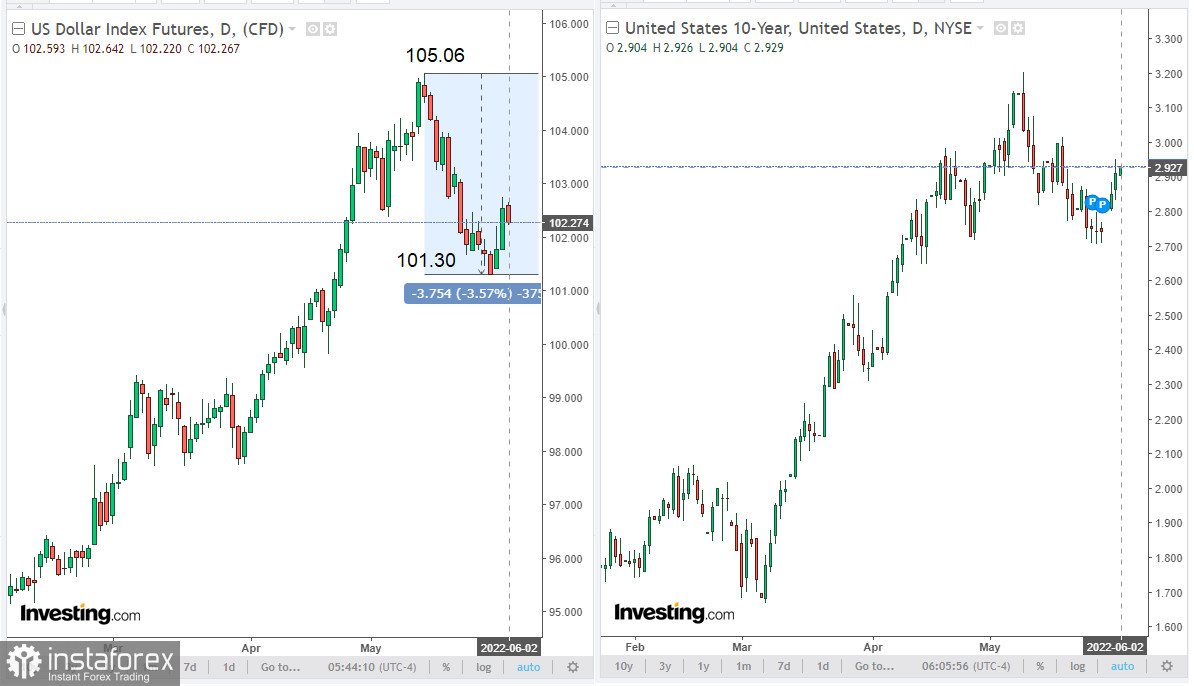

The US dollar strengthened on Tuesday and Wednesday, and the dollar index (DXY) rose by 1.01% in 2 days, to 102.53. The dollar index is down today and DXY futures are trading near 102.27 as of this writing.

Market participants are preparing for the publication (at 12:15 GMT) of the ADP report with data on the level of employment in the private sector. It is expected that the growth in the number of employees in the US private sector in May amounted to 300,000 (against an increase of 247,000 in April, 455,000 in March, 475,000 in February, and 509,000 in January). The relative growth of the indicator may have a positive impact on the dollar quotes. Although the ADP report does not have a direct correlation with the data of the US Department of Labor, which will be published on Friday (another decrease in the unemployment rate is expected, to 3.5% from 3.6% in April), it is often a harbinger of official data, having a noticeable market impact.

A little later (at 12:30), the US Department of Labor will provide data on the number of claims for unemployment benefits. It is expected that the number of initial and continuing claims for unemployment benefits will remain at the lows corresponding to the lows of the period before the coronavirus pandemic, and this is also a positive factor for the dollar, indicating the stability of the US labor market. As you know, when determining the parameters of its monetary policy, the Fed is guided (among other things) by 3 key indicators: GDP, inflation rate, and the state of the labor market. A strong report on the labor market will be another argument in favor of long positions on the dollar.

At 14:00 (GMT), the US manufacturing orders report for April will be released.Thus, during the period from 12:15 to 14:00 (GMT), an increase in volatility in dollar quotes is expected, which will affect all currency pairs with the dollar. This will also affect the XAU/USD pair.

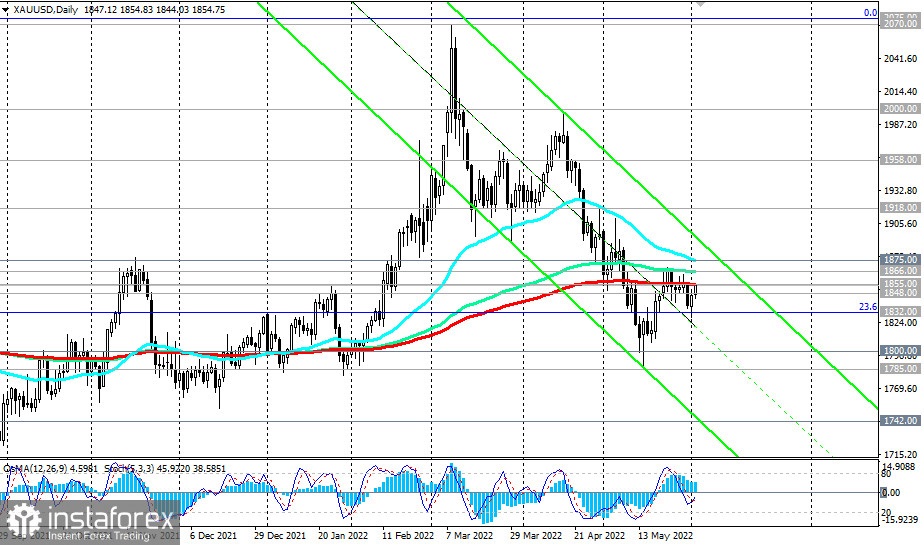

At the time of writing this article, it is trading near the 1855.00 mark, through which a key resistance level passes.

Despite the renewed growth in the yield of US government bonds, gold, which is a kind of competitor, is also in demand. As you know, gold does not bring investment income and is mainly used by investors as a tool for hedging risks (inflationary, geopolitical, economic). At the same time, its quotes are extremely sensitive to changes in the monetary policy of the world's largest central banks, primarily the Fed. When interest rates rise, gold prices tend to decline as the cost of purchasing and holding it rises.

However, demand for gold remains high, and market participants assess the risks of rising inflation and how the Fed will deal with it. If the rise in inflation "overtakes" the Fed in its efforts to contain inflation, then gold is likely to continue to rise in price. If the Fed's efforts are justified (inflation will subside, while the Fed's interest rates will remain high), then the growth in the price of gold may stop, and in the XAU/USD pair, market participants will again prefer the dollar.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română