The median estimate in a Bloomberg survey of economists called for a 318,000 advance in payrolls and for the unemployment rate to fall to 3.5%.Economists surveyed by The Wall Street Journal expected employers added 328,000 jobs last month. And they saw the unemployment rate falling slightly to 3.5%. Both surveys underestimated both the number of jobs added in May 2022 and the unemployment rate.Total nonfarm payroll employment rose by 390,000 in May, and the unemployment rate remained at 3.6%, the US Bureau of Labor Statistics reported on Friday.Notable job gains were in leisure and hospitality, professional and business services, and transport and warehousing. Employment in retail trade declined.Friday's jobs report infers that economic recovery continues to move forward despite recent actions by the Federal Reserve which is continuing its monetary and quantitative tightening.Beginning in March 2022 the Federal Reserve raised its Fed funds rate for the first time since they were lowered in 2018 to between zero and 25 basis points by 0.25% (25 basis points).This was followed by a 50-basis points rate hike at the May FOMC meeting. It is also highly anticipated that the Federal Reserve will continue this trend by raising rates an additional 50 basis points at both the June and July FOMC meetings.

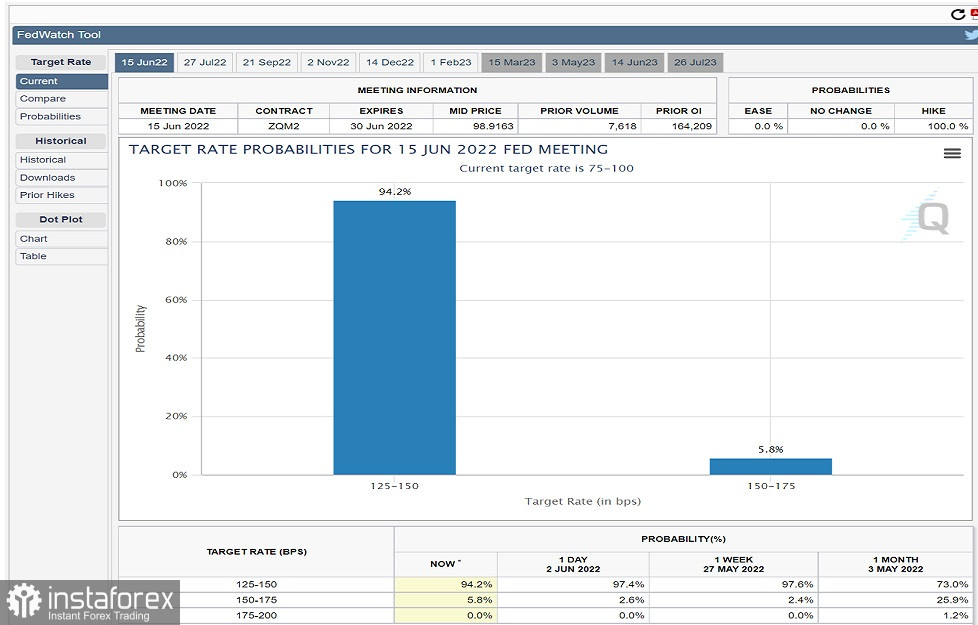

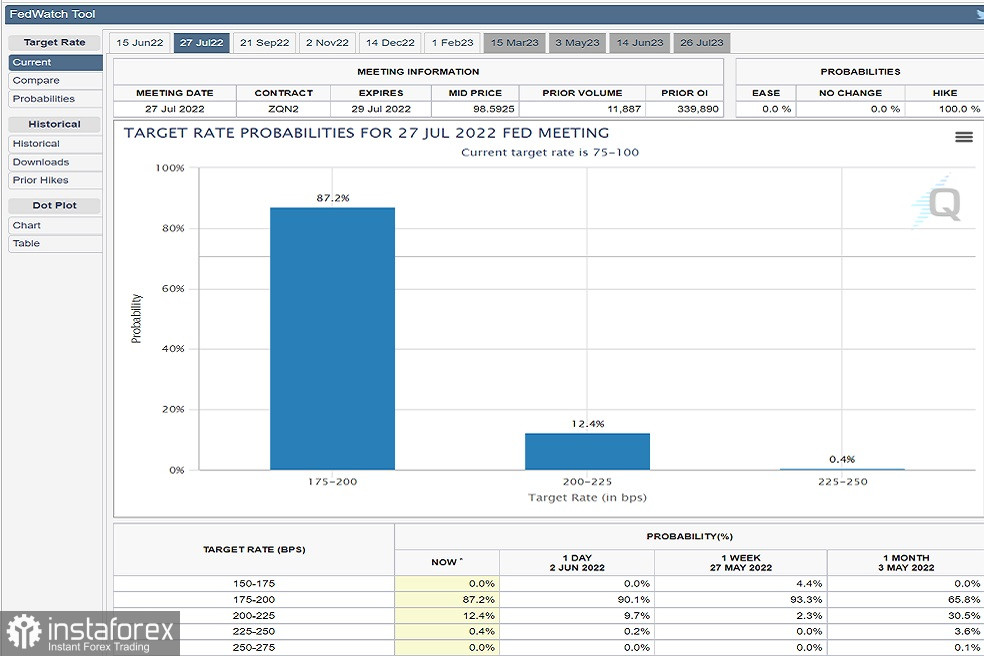

Currently, the CME FedWatch Tool is forecasting that there is a 94.2% probability that the Federal Reserve will move forward with another half a percent rate hike in June and an 87.2% probability that the Fed will raise rates another half a percent during the July FOMC meeting. The net result if these forecasts come to fruition is that the Federal Reserve will have raised its internal Fed funds rate from near zero to 2% in four months.

The reports that carry the greatest weight for the forward guidance of the Federal Reserve are the inflation report (PCE core inflation index) and the monthly jobs report. The Fed will most likely continue to implement both rate hikes and quantitative tightening (a reduction of their balance sheet) as long as inflationary pressures continue at the current elevated levels and the monthly job report does not indicate a strong reduction in new jobs added which would indicate that no major economic contraction occurred increasing the likelihood of a soft landing. Friday's jobs report resulted in a strong price decline in gold as well as a nominal increase in the value of the dollar.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română