Sell-offs continue in markets because of the US inflation report released last Friday. Global yields have risen as stocks were sold at high speed in all areas without exception, prompting the worst two-day stretch since the early 1980s. Obviously, risk appetite is falling as the threat of recession rises. The S&P 500 is down 21.8% and is now officially a bear market. Former Treasury Secretary Lawrence Summers said the US is likely to hit recession in the next two years, while a recent CNBC survey of CFOs showed that 68% expect a recession in the first half of 2023.

Meanwhile, oil is holding steady above $120/bbl as production in Libya came to a virtual halt caused by the closure of ports because of a chronic political crisis. OPEC member countries' daily production, which averaged 1.2 million barrels last year, has also fallen to about 1.1 million barrels. For commodity countries, which include New Zealand and the UK, this growth is more likely to be a plus, but inflation inevitably goes up. The OECD's latest economic forecast was bleak: growth "will be noticeably weaker than expected in almost all countries." However, even increased risks of global inflation will not be able to deter central banks from raising rates because the loss of control over inflation will lead to stagflation.

In such conditions, demand will remain high, while reasons for its decline will become less pronounced.

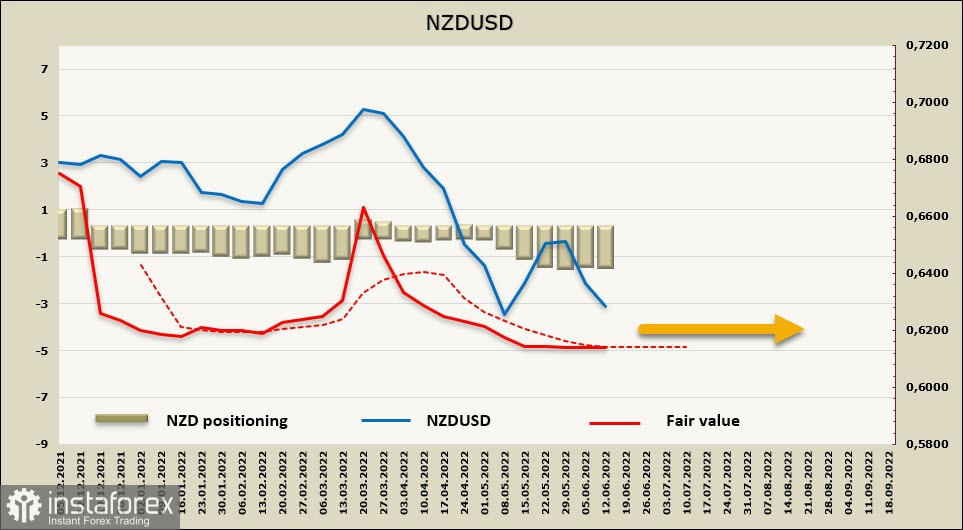

NZD/USD

During the reporting week, the net short position on NZD slightly increased by 63 million, thereby hitting -1.283 billion. This shows that the currency remains bearish, and the settlement price has no direction.

As such, it is likely that the battle around 0.6209 will end in favor of the bulls, so long positions will emerge up to 0.64, and then to 0.6530/70. Stop loss will be placed below the support line of 0.6209, a breakdown of which will continue the fall of NZD.

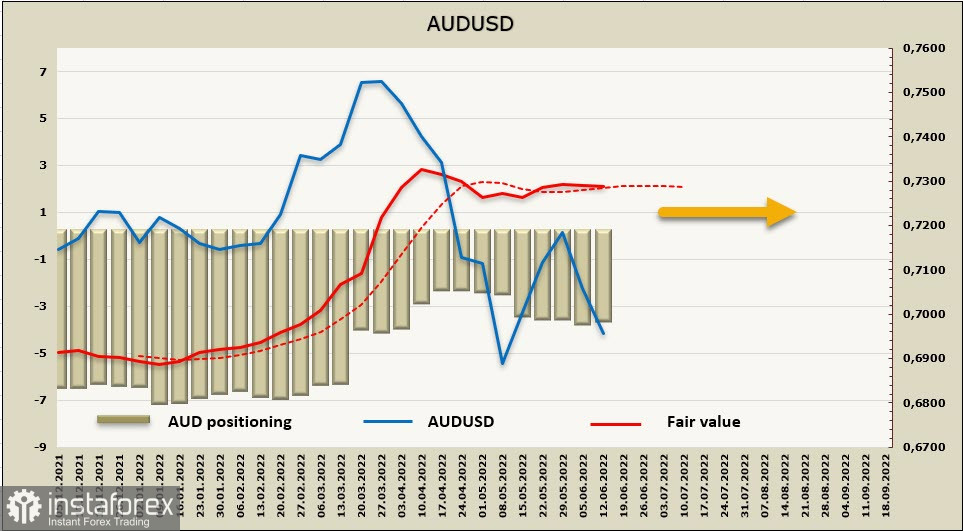

AUD/USD

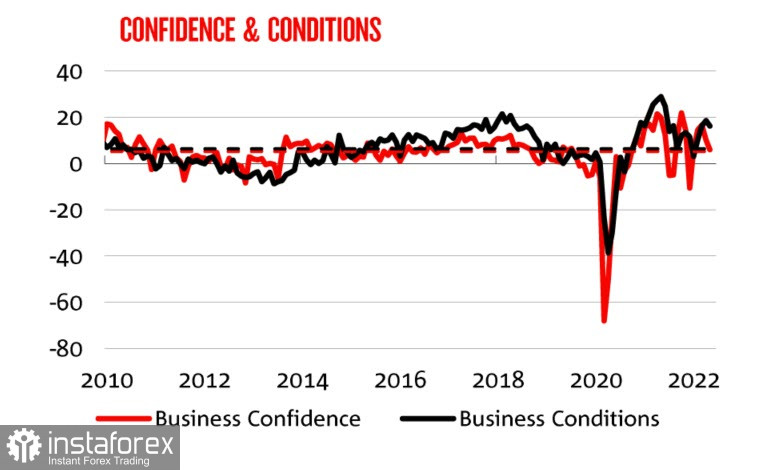

NAB's monthly business survey showed a slight decline in business conditions in May, but the figure is still above long-term averages. This means that growth is still strong in the economy and there is confidence in the business environment.

Last week, the RBA joined the club of central banks raising rates in 0.50% increments as hourly wages and inflation rise faster than expected. ANZ Bank predicts that a 50p increase will also occur in July, followed by four increases of 0.25%. By the end of the year, the rate will be 2.35%. Although this figure is less than the forecast by the Fed, given the lower inflation rate, the yield spread will remain in favor of AUD.

Weekly change in AUD, according to the CFTC report, was minimal, with net short position slightly down by 30 million to -3.464 billion. The bearish edge is still clear, and the settlement price has no direction.

AUD/USD is likely to trade horizontally before the FOMC meeting on Wednesday. Attempts to move towards 0.6828 will occur, which will then lead to a rise to 0.7140/50.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română