The pound-dollar pair is declining amid the release of data on inflation growth in the UK. The inflation report itself turned out to be very contradictory, but the downward momentum of GBP/USD is due to the general strengthening of the US currency.

Demand for the dollar is growing ahead of the speech of Fed Chairman Jerome Powell in the US Congress. Powell will announce the semi-annual report and answer questions from congressmen. This is an important event that, as a rule, has a significant impact on the mood of the market.

Moreover, at the moment there is a certain intrigue regarding Powell's rhetoric. According to some experts, he will admit the probability of a 75-point rate hike not only at the July meeting, but will not rule out such a scenario in the context of the September meeting.

But back to British inflation. Today's release really turned out to be controversial—the published figures can be interpreted both in favor of the pound and against it.

On the one hand, the overall consumer price index rose again year-on-year, this time to 9.1%. The indicator has been showing consistent growth over the past 8 months. A similar dynamic was demonstrated by another indicator—the producer price index, which growth may be an early indication of increased inflationary pressure. Growth of up to 2.1% (in monthly terms) was recorded, with a growth forecast of up to 1.9%. In annual terms, the indicator also came out in the "green zone," rising to 22.1%. The producer price index added to the positive picture, also being above the forecast values.

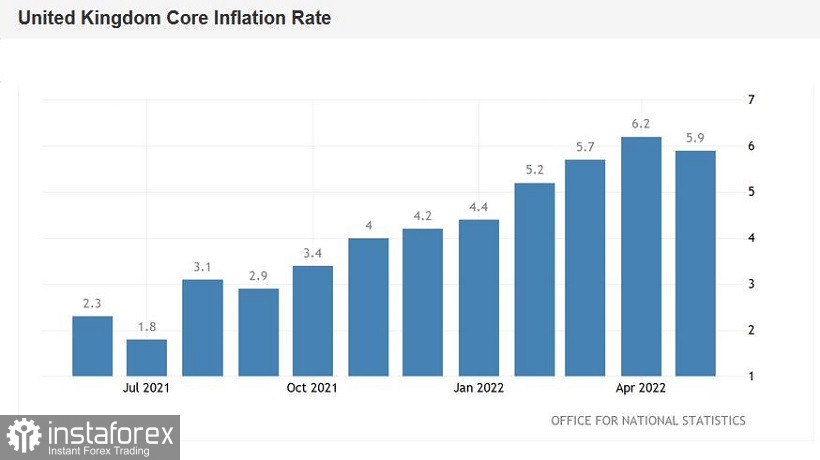

On the other hand, core inflation disappointed. And this factor, by and large, leveled the achievements of the other components of the release. The core consumer price index has shown positive dynamics over the past 7 months, but in May it still slowed down its growth, contrary to the opposite forecasts of most analysts. The indicator came out at around 5.9% with a forecast of growth to 6.0%. In the previous month, the indicator peaked at 6.2%.

After the publication of the inflation report, the market was again cautiously talking about the fact that the Bank of England might revise its policy regarding the pace of interest rate hikes. To be more precise, the regulator can maintain the pace that was indicated at the end of the June meeting. Note that significant disagreements arose at the June meeting of the Central Bank's Monetary Policy Committee. Three members of the BoE—Michael Saunders, Catherine Mann, and Jonathan Haskel - voted to raise the rate by 50 basis points. But they remained in the minority, as the other six of their Committee colleagues insisted on a 25-point increase. If the pace of core inflation slows further, the 50-point boosters will remain in the minority (if not reconsidered at all).

This factor did not allow GBP/USD buyers to develop corrective growth: the mark of 1.2300 (Kijun-sen line on the daily chart) remained unconquered. Traders have been trying to overcome this target for the past two days, but in vain. Moreover, today the bears of the pair once again seized the initiative and tested the area of the 21st figure.

In general, if we disregard intraday price fluctuations, we can conclude that the GBP/USD pair is stuck in flat ahead of Powell's speech in Congress. Last week, the pound fell to 1.1933, after which GBP/USD sellers took profits and provoked an upward pullback. The upward corrective trend also quickly choked—as mentioned above, buyers were unable to conquer the area of the 23rd figure. As a result, the price got stuck in the range of 1.2160–1.2290, waiting for the next information impulse.

It is obvious that Powell will set the tone for trading today. It is likely that he will voice a hawkish position, declaring the need to tighten monetary policy at an aggressive pace. Yesterday, Richmond Fed President Thomas Barkin made it clear that many members of the Fed support the idea of a 75-point rate hike following the results of the July meeting. Note that earlier Powell announced that in July the Fed would increase the rate by either 50 or 75 basis points. It is likely that today the head of the Fed will make it clear to congressmen that the regulator is ready to raise the rate by 75-point steps, not only in July but also in September. Such a message will significantly strengthen the position of the US currency, including in pair with the pound.

Thus, in my opinion, before Powell's speech, the GBP/USD pair will be trading in the range of 1.2160–1.2290. Further prospects will depend on the rhetoric of the head of the Fed: if he supports the greenback, the pair may go to the base of the 21st figure. Otherwise, buyers will overcome the resistance level of 1.2300 (Kijun-sen line on D1) and try to approach the next price barrier 1.2380 (middle Bollinger Bands line on the same timeframe).

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română