Bitcoin seemed to have reached the bottom when there was a knock from the bottom of the bunker. By the end of June, against the background of large-scale sales, the market value of all cryptocurrency assets had decreased to $939 billion. In November 2021, it was about $3 trillion! How, in this case, can we not talk about the collapse? Will Bitcoin and other cryptocurrencies disappear? They will not disappear, since the psychology underlying them is skeptical about the management of the money supply by the current government is eternal. Another thing is that it's early days yet.

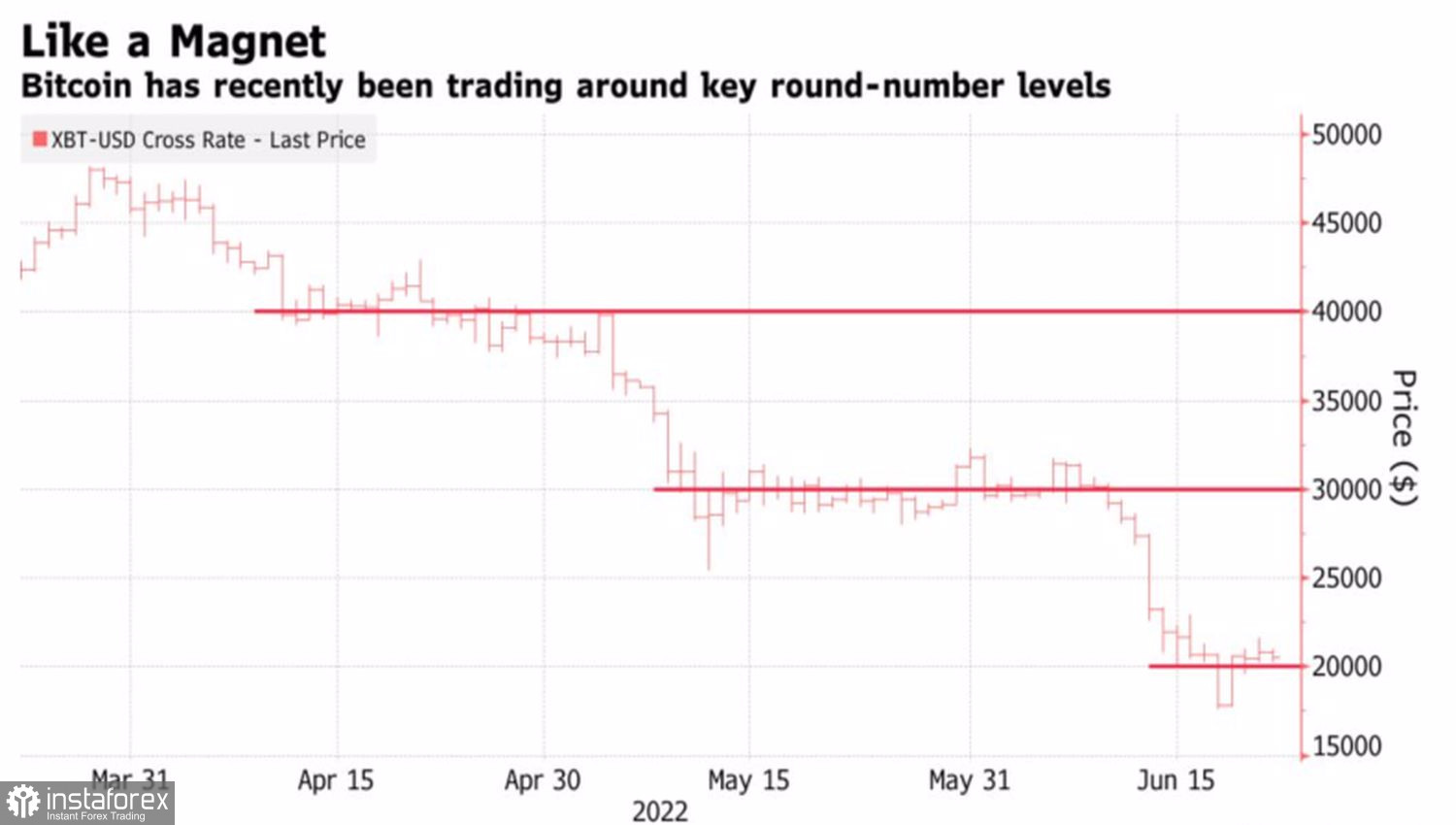

After captivating sales, BTCUSD quotes have entered a phase of consolidation, which looks quite logical at current levels. Indeed, the token has previously entered a narrow trading range near psychologically important levels.

Bitcoin dynamics

Bulls do not lose hope for a consolidation in the current area with subsequent recovery. So, the fact that the flow of moving Bitcoins to exchanges from cold wallets—autonomous storage—for subsequent sale is decreasing speaks about the potential day of the leader of the cryptocurrency sector. Over the past 7 days, this figure has dropped to 92,470 tokens from a recent peak of 137,326, according to CryptoQuant.

According to research by Glassnode, 56% of all Bitcoins in hand are still worth more than they were when they were purchased. Previously, the company claimed that the average purchase price of the token is 23,430.

After a series of refusals to fulfill their obligations by several industry institutions, the rest are trying to keep customers with new conditions. Thus, the Binance cryptocurrency exchange began to allow users of its services to trade Bitcoins and other assets without commission for spot transactions.

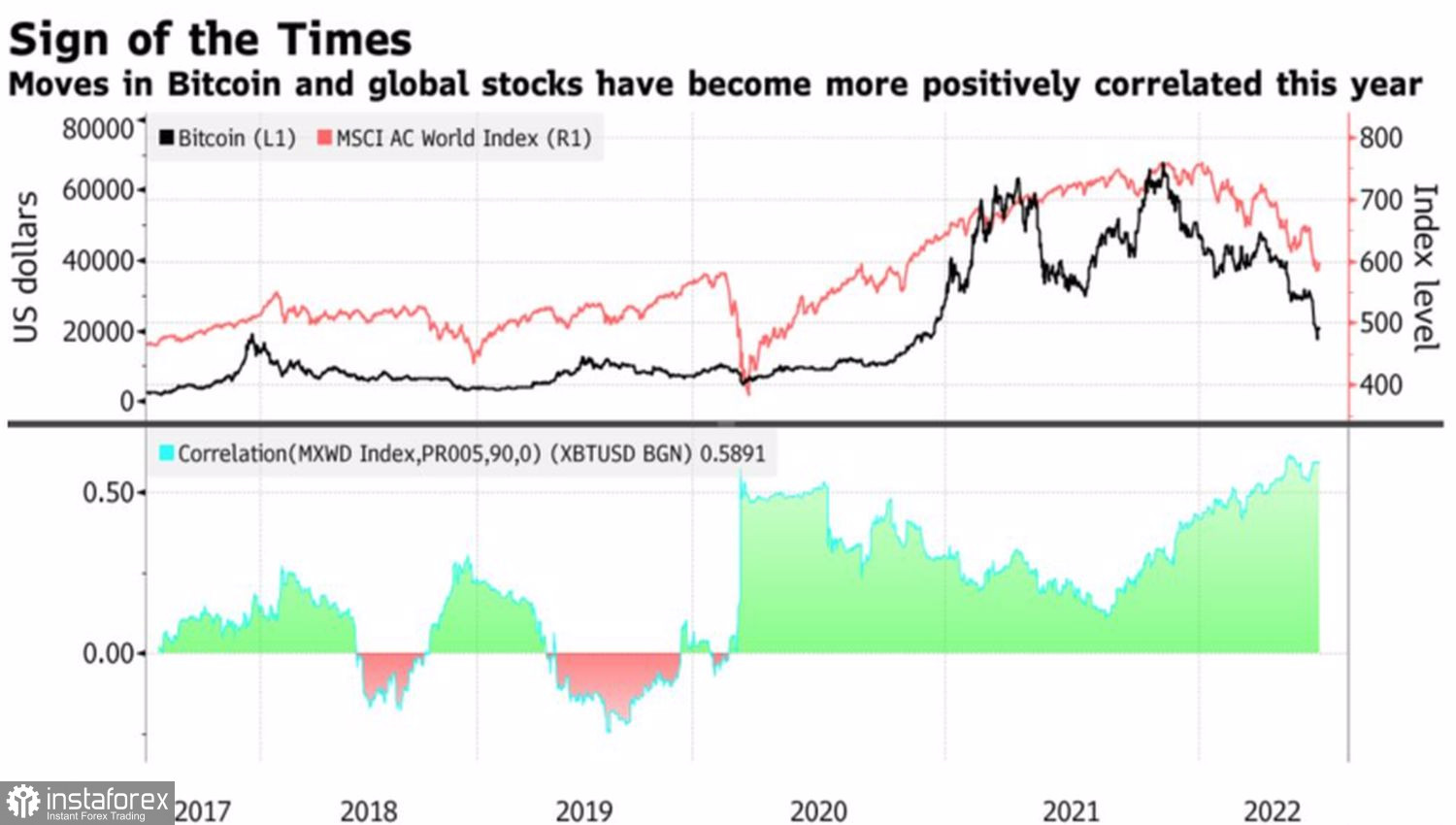

Alas, neither fair value calculations nor goodies from crypto institutions are unlikely to change the balance of power in the market. It is at the mercy of the bears as concerns about the excessive tightening of the Fed's monetary policy put pressure on all risky assets. Stocks and stock indices fall—bitcoin falls. At the same time, the market began to discuss what is primary, a chicken and egg situation—cryptocurrencies affect the Nasdaq Composite or vice versa.

Dynamics of the Correlation Between Bitcoin and the Global Equity Index

BTCUSD, Daily chart

According to Mobius Capital Partners, the token is a measure of investor sentiment. Where it goes, there are American stock indices. In my opinion, this is incorrect. The previous rally in these assets was based on the massive amounts of cash liquidity from the Fed. As soon as the central bank began to take this money, BTCUSD and the Nasdaq Composite collapsed sharply. These are just similar assets, not leading indicators for each other.

Technically, on the daily chart, BTCUSD quotes have reached point 5 of the Wolfe Wave pattern, which suggests the formation of a bottom. However, to break the downward trend, it is necessary to return to the 2–4 line, which approximately corresponds to the level of 30,000. In the meantime, Bitcoin should be sold on the rise to 23,000 and 24,500.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română