Global stock indices continued their rally on Monday following last week's best-ever monthly performance.

US stock futures climbed. The Nasdaq 100 index rose 0.5%. The tech-heavy, including Amazon.com Inc., Apple Inc. and Microsoft Corp. rallied at the premarket. Shares of technology companies also lifted indexes in Europe and Asia.

Quarterly portfolio rebalancing by institutional buyers could be helping equities, as investors assess whether inflation is cresting and recession can be averted.

JPMorgan Chase & Co.'s Marko Kolanovic is calling for stocks to rise 7% next week as pension and sovereign wealth funds rebalance their portfolios.

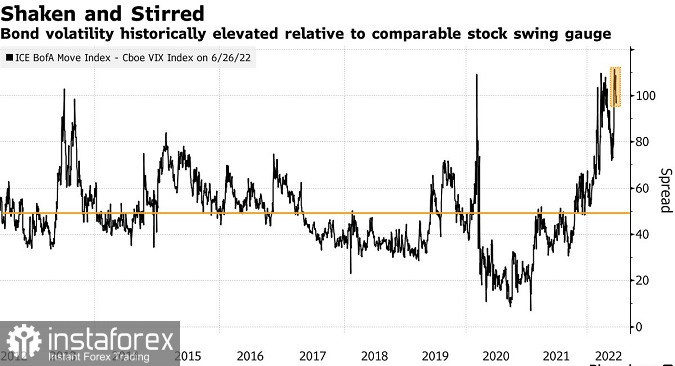

Treasuries slumped, pushing the US 10-year bond rate to 3.16%. Yields fell back from June's highs amid growth concerns. However, it is not clear whether this means the end of the bear market for treasuries.

Among notable European stock moves, Prosus NV soared on plans to sell more of its US$134 billion stake in Chinese internet giant Tencent Holdings Ltd to finance a buyback program.

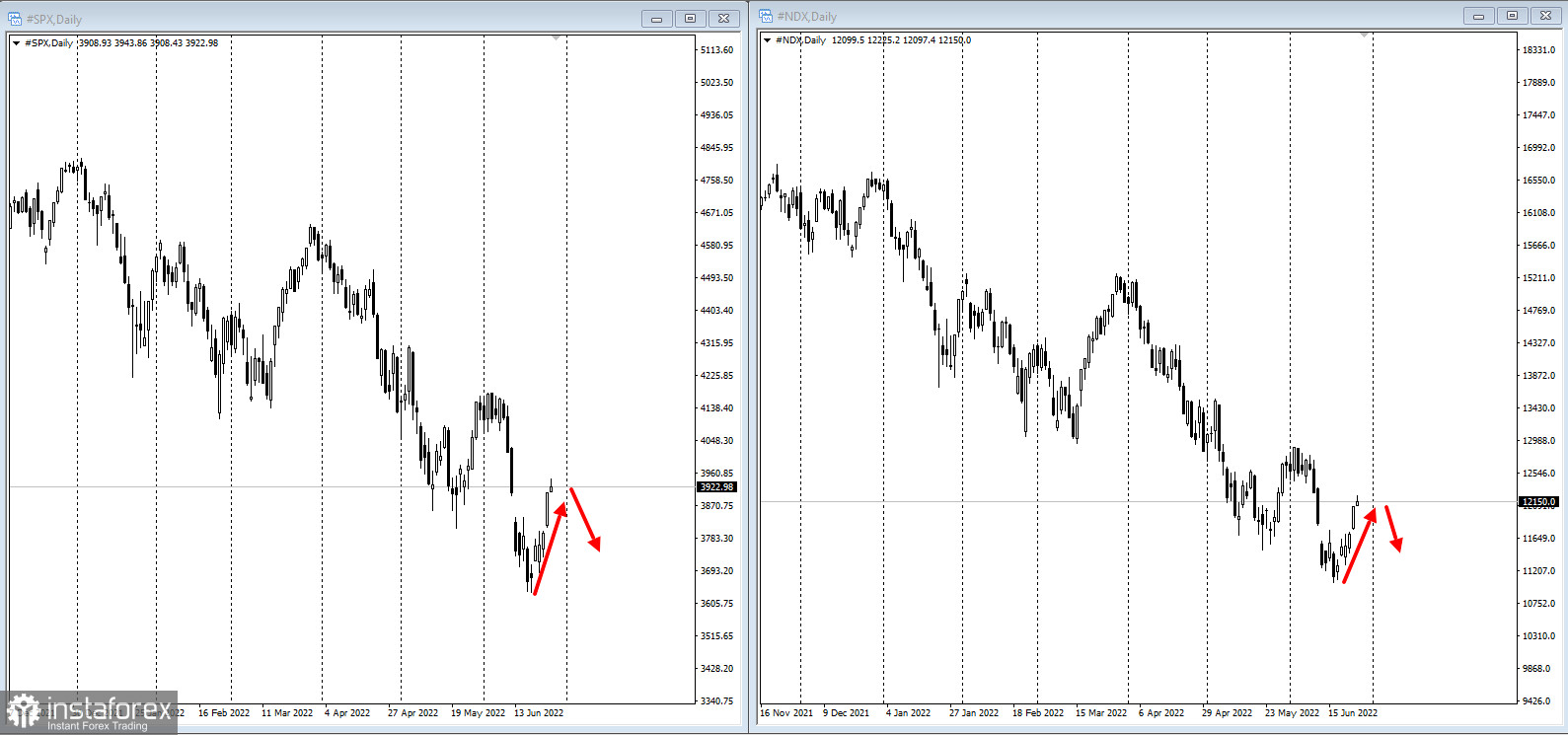

Meanwhile, one of Wall Street's most prominent bears sees the current rally in US stocks extending, prior to the selloff recommencing. Morgan Stanley strategists led by Michael Wilson say the S&P 500 Index may climb another 5% to 7%, before resuming losses.

Investors are analyzin incoming data to determine whether inflation is close to a peak. Over time, this could give policymakers the leeway to mitigate steep interest rate rises. An even more worrying scenario is continued price pressures and policy tightening, even as the global economy slumps.

"There's a feeling that things aren't as bad as we thought they were going to be," Carol Pepper, founder of Pepper International, said. She added, "there's a hope that perhaps we've oversold, perhaps there's not going to be a recession."

Russia defaulted on its foreign-currency sovereign debt for the first time in a century, the culmination of ever-tougher Western sanctions that shut down payment routes.

Traders are keeping an eye on the summit of the G7 leaders, who plan to pledge indefinite support for Ukraine. In addition, the G-7 will discuss price caps on Russian oil.

The US, UK, Japan, and Canada also plan to announce a ban on new gold imports from Russia during the G7 summit. The precious metal's prices soared.

What to watch this week:

US durable goods, MondaySan Francisco Fed President Mary Daly is interviewed by LinkedIn's chief economist, TuesdayECB President Christine Lagarde, Federal Reserve Chair Jerome Powell, BOE Governor Andrew Bailey and Cleveland Fed President Loretta Mester due to speak at ECB event, WednesdayUS GDP, WednesdaySt. Louis Fed President James Bullard speaks, WednesdayChina PMI, ThursdayUS personal income, PCE deflator, initial jobless claims, ThursdayEurozone CPI, FridayUS construction spending, ISM Manufacturing, Friday

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română