The market has long been dominated by the opinion that the acceleration of inflation is a strong argument for buying gold, which can protect your money better than deposits or bonds. However, ahead of US consumer price data for June, XAUUSD quotes fell to a 9-month low. At the same time, Bloomberg experts expect CPI to accelerate to 8.8%. Paradox? It is quite possible that the majority is mistaken, and the precious metal can predict the dynamics of inflation and not vice versa.

ARK Invest argues that the Fed is making a big mistake by tightening monetary policy as deflationary forces begin to show. The first of them is the US dollar trading in the area of 20-year peaks. Falling Treasury bond yields and oil prices indicate that a recession is approaching—a weakening demand. It is also a deflationary force. Finally, the 12% drop in gold over the past three months is another argument that consumer prices will start to slow down soon. The Fed is simply obliged to realize its mistake and pause in the process of monetary restriction.

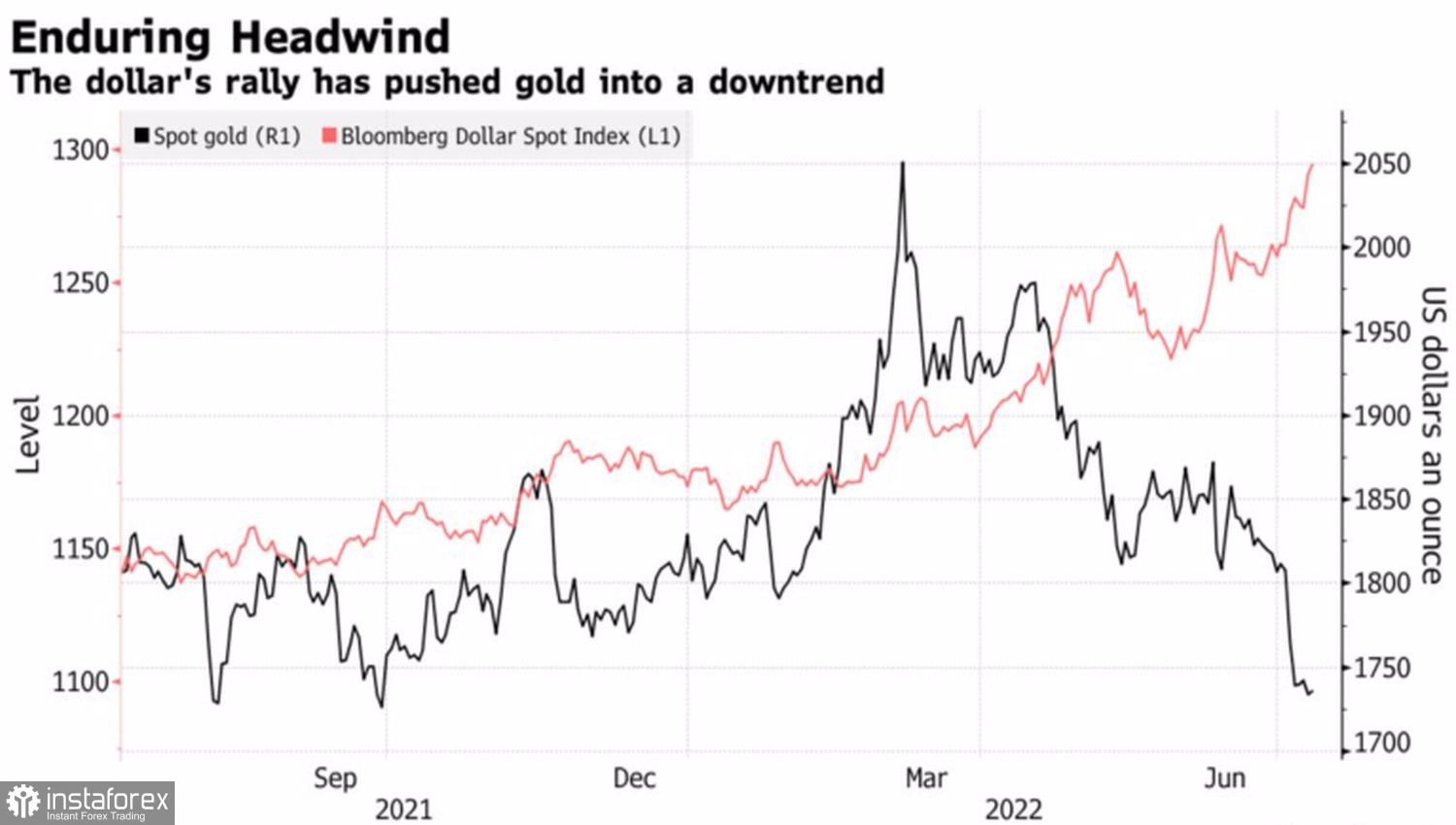

Historically, the Fed's tightening monetary policy creates an unfavorable background for the precious metal. In such conditions, as a rule, the US currency strengthens. Since gold is traded in US dollars, the growth of the USD index is a clear negative for XAUUSD.

Dynamics of gold and US dollar

Since the beginning of the year, the US dollar has strengthened by 12%, and half of its growth occurred last month. Unsurprisingly, the entire commodities sector is suffering. And precious metals are no exception. At the same time, according to Commerzbank, the growth of gold prices is not only hindered by the US dollar, but also by the continuing steady outflow from gold-oriented ETFs. Specialized exchange-traded funds have suffered losses for four consecutive weeks. Moreover, according to the results of the five-day period by July 8, an outflow of 29 tons was recorded, the largest in almost two months.

According to the World Gold Council, investors withdrew $1.7 billion from the ETF in June after $3.1 billion in May. Withdrawals, coupled with falling prices, led to a reduction in stocks of specialized exchange-traded funds by 7%, to $221.7 billion at the end of the second quarter. It has moved away from the $240 billion March peak but is still 5.9% higher than at the beginning of the year.

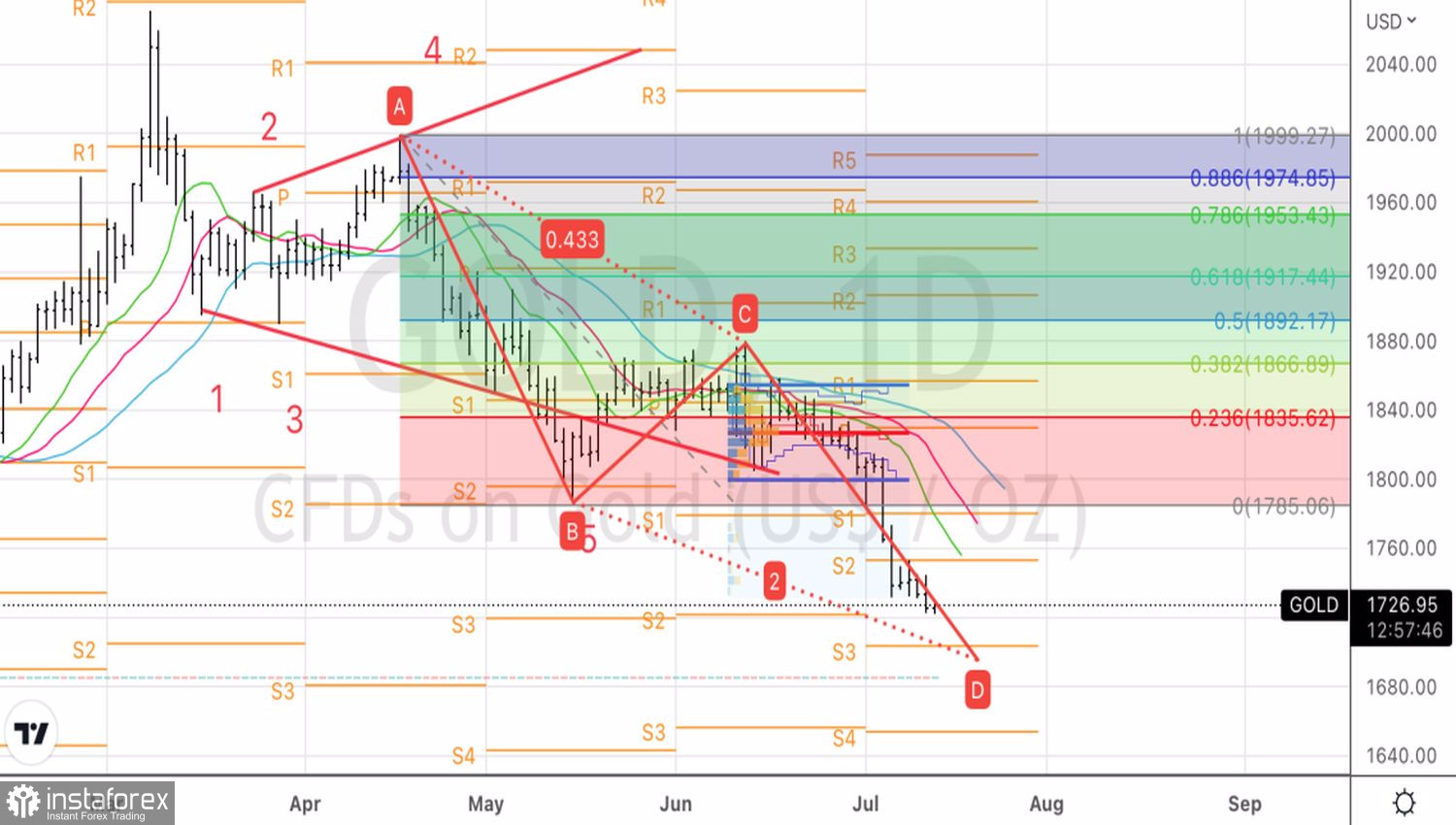

Based on Quant Insight's model, which takes into account factors such as economic growth, inflation, financial conditions, real returns, credit spreads and risk appetite, the fair value of gold is $1791 per ounce. At the same time, the company notes that the indicators continue to deteriorate, which signals the short-term weakness of XAUUSD.

Technically, on the daily chart, after working out the Broadening wedge pattern, which allowed us to form shorts at attractive levels, gold is moving steadily towards the target by 200% according to the AB=CD harmonic trading model. It corresponds to $1700 per ounce. The recommendation is to sell.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română