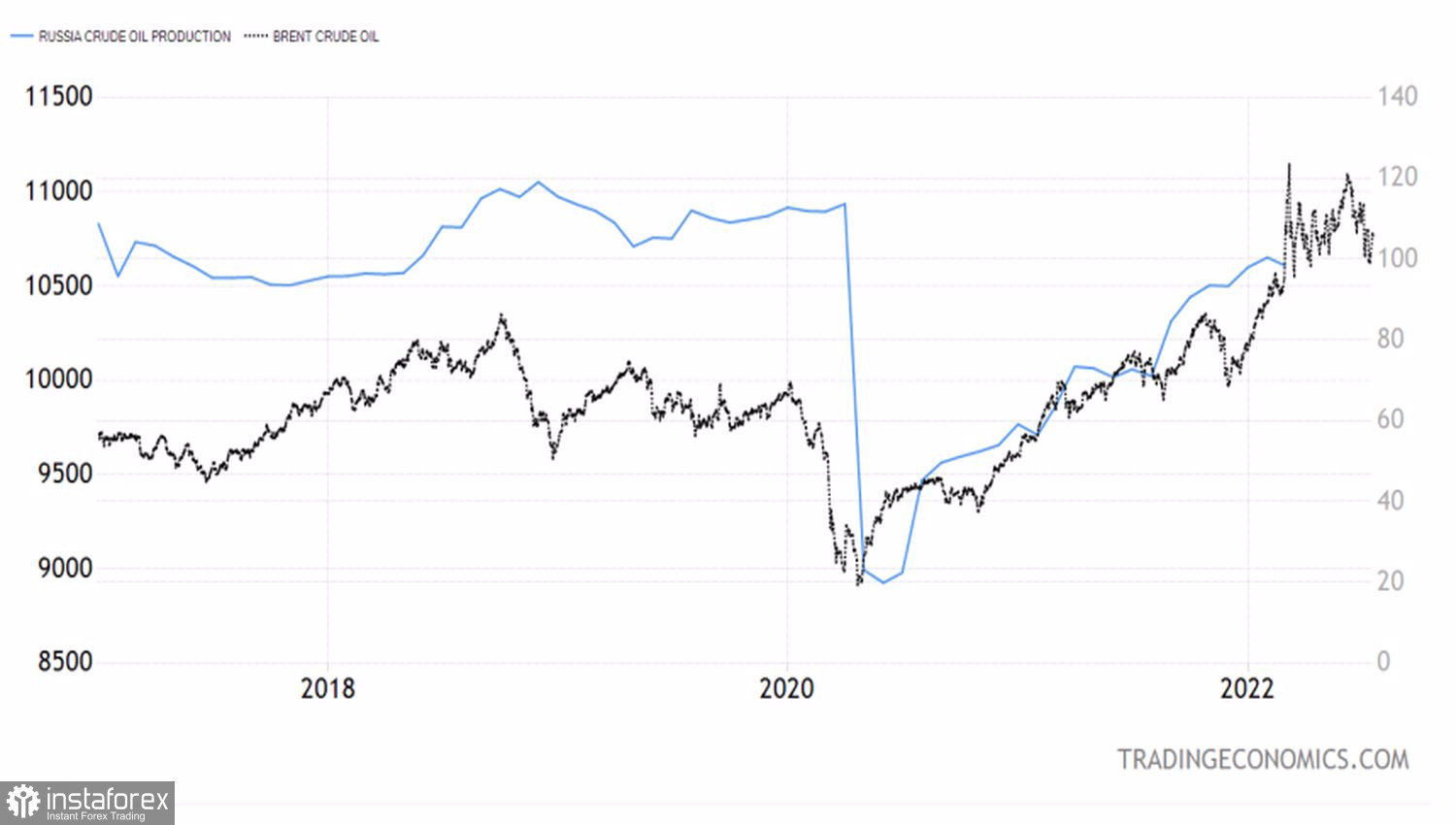

Brent's rise above $135 per barrel at the end of February was due to a combination of two factors: investor confidence in the rapid growth in demand against the background of the global economic recovery after the pandemic and the supply shock associated with concerns about the displacement of Russia from the market. In fact, everything turned out to be not so extreme. According to the IEA, Western sanctions against the Russian Federation have had less effect than originally expected, and the country continues to increase production. At the same time, fears of an imminent global recession are undermining demand. Bulls on the North Sea grade began to take profits, which lowered the quotes to the 5-month bottom. From which oil is trying to rebound.

The nature of commodity markets is cyclical. Prices that are too high scare away consumers, which leads to lower prices. Oil is no exception. The global economy cannot sustain Brent at $120–125 per barrel. The North Sea variety simply does not find buyers at such a price. Especially at a time when central banks are raising rates like crazy in order to suppress excessively high inflation. The chances of a recession are growing like mushrooms after the rain, negatively affecting demand. The International Energy Agency (IEA) lowered its forecast for 2022 by 240,000 bpd to 99.2 million bpd. In 2023, the figure will be at 101.3 million bpd, which is also lower than previous estimates.

The embargo of the United States, Britain and the EU on Russian oil has not yet brought results. The Russian Federation remains a major player in the oil market, and according to the IEA, it will produce 10.6 million bpd in 2022, which is higher than the previous forecast by 240,000 bpd. The estimate for global production was also increased by 300,000 bpd to 100.1 million bpd.

Dynamics of Brent and oil production in Russia

If instead of the expected expansion of the deficit, there is a narrowing of it, then the February peak will remain the peak in the coming months and possibly years. A return to it is unlikely, however, a significant drop in Brent is unlikely to be expected. Unless OPEC+ begins to work wonders and increase production, as Joe Biden wants. Investors' expectations that the US president's visit to Saudi Arabia will be effective have lowered the quotes of the North Sea variety below $100 per barrel. Nevertheless, Riyadh noted that decisions will be made under market logic and within the framework of the Alliance. This allowed the oil to surface.

The growth of futures quotes is facilitated by information about the failure of the Keystone pipeline—which limits the supply of Canadian oil to the US, Iraq's statement that Brent will trade at $100 per barrel and above this year, as well as some weakening of the US dollar against major world currencies.

Technically, the combination of the Wolfe Wave and Anti-Turtles reversal patterns on the daily Brent chart signals the exhaustion of the short-term downward movement. A break of resistance at $107 per barrel is a reason for the formation of longs.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română