Market participants were so discouraged by the recent report of the US Bureau of Economic Analysis (BEA) with data on the country's GDP that they continue to actively sell the dollar. Due to the inertia received from the negative momentum last week, the dollar continues to decline at the beginning of the new week.

As of this writing, futures for the dollar index (DXY) were trading near 105.37, 40 points below last week's close. If the decline continues, it will be the 3rd consecutive week of dollar weakening.

The dollar did not receive support from the Fed meeting, which ended last Wednesday with an increase in interest rates by 0.75%. The tough rhetoric of the members of the US central bank regarding their intentions to aggressively curb inflation growth also failed to stop the dollar's decline.

It seems that investors were alarmed by the statements of Fed Chairman Jerome Powell that the further course of the tightening cycle of monetary policy will be accompanied by a period of "lower economic growth, weakening of the labor market."

"We expect a period of below-trend economic growth," Powell said. And on Thursday, his words were confirmed in the latest data on US GDP. The BEA report states that GDP again decreased by -0.9% in the 2nd quarter, following the fall of -1.6% in the 1st quarter.

By all indications, this is a recession. It is not yet stagnation or stagflation (zero or negative GDP dynamics amid high inflation), but the situation is alarming. If it continues to deteriorate, the American economy will face a decline in production, a period of high unemployment, and a significant decline in the population's standard of living. If so, tightening monetary policy by raising interest rates in a recession is suicidal.

By the end of this year, the Fed may have to switch again from tightening to easing its monetary policy. Moreover, during the primary elections to the US Congress (in early November), Biden and the Democrats will have to somehow explain the sharp deterioration in the economic situation in the United States. If the Fed really needs to slow down the process of tightening its policy or even reverse this process, then a new cycle of dollar decline will not be avoided.

Thus, the past week could be a turning point in the dynamics of the dollar. If the monthly report of the US Department of Labor published on Friday (at 12:30 GMT) also turns out to be disappointing, then we should expect a further fall in the dollar and its DXY index.

In the meantime, the labor market seems to be the only bright spot in the deteriorating economic situation in the US economy.

Previous report values (average hourly wages / number of new jobs created outside the agricultural sector / unemployment rate): +0.3% in June, May and April, +0.4% in March, 0% in February, +0 .7% in January 2022 / +0.372 million in June, +0.390 million in May, +0.428 million in April, +0.431 million, +0.678 million in February, +0.467 million in January 2022 / 3.6% in June , May, April and March, 3.8% in February, 4.0% in January 2022.

Forecast for July: +0.3% / +0.250 million / 3.6%, respectively.

Of the important macro data awaiting publication today, it is worth paying attention to the business activity index (PMI) in the manufacturing sector from the Institute of Supply Management (ISM), which is an important indicator of the state of this sector and the American economy as a whole. Its publication is scheduled for 14:00 (GMT).

Market volatility will also increase during tomorrow's Asian trading session: at 04:30 (GMT), the decision of the RBA on the interest rate will be published. Its next increase is expected (to the level of 1.85%). The AUD is likely to react positively to the RBA's decision to raise interest rates. But if the RBA signals its intention to pause further in the accompanying statement, the Australian dollar will come under pressure. However, the market's reaction to the decision of the RBA regarding the interest rate in the current situation may be completely unpredictable.

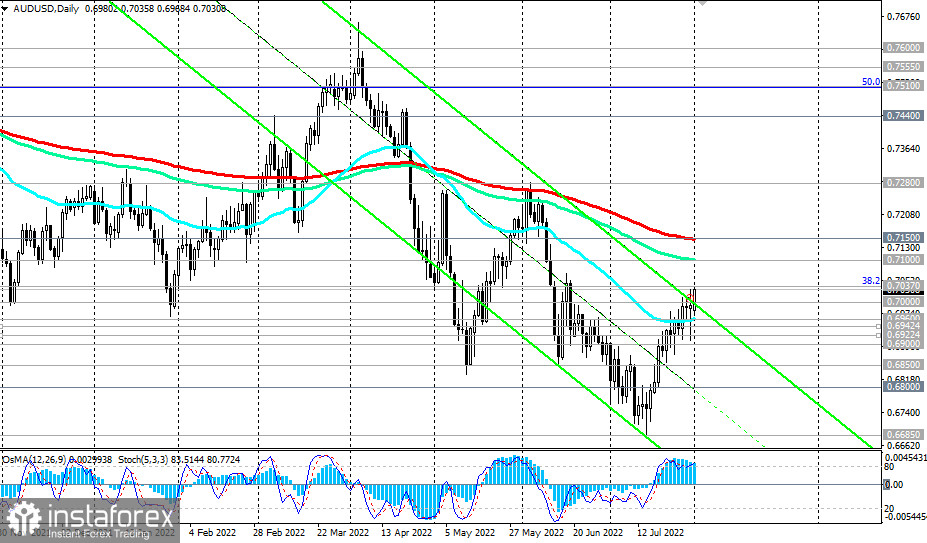

As of this writing, the AUD/USD pair is trading near the 0.7030 mark, developing upward momentum above the important short-term support levels of 0.6942, 0.6922.

The targets of this upward correction so far are the key resistance levels 0.7100, 0.7150.

Tiếng Việt

Tiếng Việt

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română